GST and the Economic Growth of India.

GST and the Economic Growth of India.

GST AND THE ECONOMIC GROWTH OF INDIA

The introduction of the Goods and Services Tax (GST) in India on July 1, 2017, was a significant economic reform that aimed to simplify the country’s indirect tax structure, enhance tax compliance, and boost economic growth.

What is GST:

GST, or Goods and Services Tax, is an indirect tax that has taken the place of several other indirect taxes in India, such as excise duty, VAT, and services tax. The GST Act was approved by Parliament on March 29, 2017, and has been in effect since July 1, 2017.

In simple terms, the GST is a tax that is applied to the supply of goods and services. It is a comprehensive, multi-stage, destination-based tax that is levied on every value addition. The GST is a unified domestic indirect tax law that covers the entire country.

Under the GST regime, the tax is levied at every point of sale. In the case of intra-state sales, Central GST and State GST are charged. All the inter-state sales are chargeable to the Integrated GST.

Types of GST:

There are three types of taxes applicable under GST:

- Central Goods and Services Tax (CGST): This is the tax collected by the Central Government on an intra-state sale, i.e., a transaction taking place within the boundaries of a state. For example, if a business sells goods within Maharashtra, CGST will be levied and collected by the Central Government.

- State Goods and Services Tax (SGST): This is the tax collected by the State Government on an intra-state sale, i.e., a transaction taking place within the boundaries of a state. For example, if a business sells goods within Maharashtra, SGST will be levied and collected by the State Government.

- Integrated Goods and Services Tax (IGST): This is the tax collected by the Central Government on an inter-state sale, i.e., a transaction taking place between two states or a transaction involving import/export of goods or services. For example, if a business in Maharashtra sells goods to a customer in Tamil Nadu, IGST will be levied and collected by the Central Government.

Components of the GST:

- GST Registration:Every business that supplies goods or services is required to register under the GST law, subject to a threshold limit. The registration process is online, and businesses are required to provide various details such as their business name, PAN, and bank account details.

- GST Rates: The GST law provides for four major tax rates – 5%, 12%, 18%, and 28% – depending on the nature of goods or services supplied. In addition to these rates, certain goods and services are exempt from GST or are subject to a lower tax rate.

- Input Tax Credit: Under the GST law, businesses are allowed to claim input tax credit for taxes paid on inputs used in the production of goods or services. This includes taxes paid on goods purchased or services availed by the business.

- GST Returns: Businesses are required to file monthly or quarterly GST returns, depending on their turnover. The GST returns contain details of the goods or services supplied, the tax collected, and the input tax credit claimed.

- GST Compliance: The GST law provides for various compliance requirements, including maintenance of books of accounts, issuance of invoices, and payment of taxes within the prescribed time limits.

Objectives of GST:

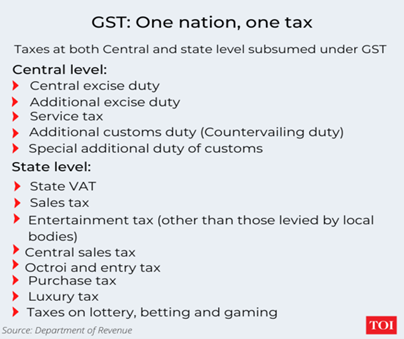

- ‘One Nation, One Tax’ Ideology: The implementation of GST has replaced multiple indirect taxes, resulting in a single tax rate for goods and services across all states. This has simplified tax administration and compliance, and introduced common laws such as e-way bills and e-invoicing for transaction reporting.

- Subsuming Multiple Indirect Taxes: GST has subsumed all major indirect taxes, reducing the compliance burden on taxpayers and easing tax administration for the government.

- Eliminating the Cascading Effect of Taxes: GST has eliminated the cascading effect of taxes that occurred due to the inability to set off tax credits of one tax against the other in the previous tax regime. The tax levy is now only on the net value added at each stage of the supply chain, promoting the seamless flow of input tax credits across both goods and services.

- Curbing Tax Evasion: GST has stricter laws to curb tax evasion compared to previous tax laws. The input tax credit can only be claimed on invoices uploaded by respective suppliers, minimizing the chances of claiming input tax credits on fake invoices. The nationwide tax and centralised surveillance system have contributed to quicker and more efficient clampdown on defaulters.

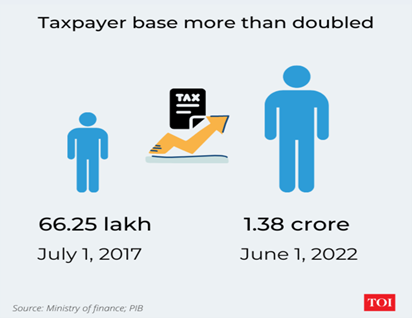

- Increasing Taxpayer Base: GST has widened the tax base in India, increased tax-registered businesses, and brought certain unorganised sectors under the tax net, such as the construction industry.

- Online Procedures for Ease of Doing Business: GST procedures are carried out almost entirely online, contributing to the overall ease of doing business in India. The government plans to introduce a centralised portal soon for all indirect tax compliance.

- Improved Logistics and Distribution System: GST minimises transportation cycle times, improves supply chain and turnaround time, and leads to warehouse consolidation. The e-way bill system under GST has removed interstate checkpoints, improving transit and destination efficiency.

- Promoting Competitive Pricing and Increasing Consumption: GST has led to overall competitive pricing across India and on the global front, resulting in increased consumption and indirect tax revenues.

Advantages Of GST:

- GST has mainly removed the cascading effect on the sale of goods and services. Removal of the cascading effect has impacted the cost of goods. Since the GST regime eliminates the tax on tax, the cost of goods decreases.

- Also, GST is mainly technologically driven. All the activities like registration, return filing, application for refund and response to notice needs to be done online on the GST portal, which accelerates the processes.

Source: Cleartax

GST and Fiscal Federalism:

GST has promoted fiscal federalism in India by establishing a uniform tax system across the country. This has reduced tax evasion and inefficiencies. Both the Central and State Governments have the power to levy and collect taxes on the same transaction, and the tax revenue collected is shared based on a revenue-sharing formula. The GST Council has also been established to foster cooperation between the Central and State Governments. Overall, GST has helped to strengthen the relationship between the different levels of government and create a more efficient tax system.

Supreme Court Judgements:

Some landmark Supreme Court rulings related to GST reform in India:

- In the case of Union of India v. Adfert Technologies Pvt Ltd. (2017), the Supreme Court held that the GST Council was the sole authority to decide on tax rates and classification of goods and services under GST.

- In the case of Commissioner of State Tax v. Ultratech Cement Ltd. (2018), the Supreme Court held that the input tax credit mechanism under GST was a fundamental feature of the GST regime and was intended to avoid cascading effects of taxes. It also held that the denial of input tax credit could not be based on the grounds of procedural lapses or non-compliance of certain requirements.

- In the case of Mohit Minerals Pvt. Ltd. v. Union of India (2020), the Supreme Court held that the validity of the levy of GST cannot be questioned on the ground that the Constitution (One Hundred and First Amendment) Act, 2016, which introduced GST, was not passed by the required number of states.

- In the case of State of Gujarat v. Utility Users Welfare Association (2021), the Supreme Court held that the levy of GST on the transfer of development rights was valid and that the transaction would qualify as a taxable supply under GST.

CBIC measures:

- Simplification of GST Returns: To reduce the compliance burden on taxpayers, CBIC has simplified the GST return filing process by introducing a new return filing system called GST Returns 2.0. This system has fewer and simpler return forms, making the filing process easier for taxpayers.

- E-Invoicing: CBIC has implemented e-invoicing for businesses with a turnover of more than Rs. 50 crores to automate the process of invoice generation and reduce errors in GST returns.

- Tackling Fraudulent Activities: CBIC has taken several measures to prevent fraudulent activities like fake invoicing, which have been a major challenge in the GST regime. The Board has introduced a system of verification of taxpayers through Aadhaar authentication and has also implemented a system of e-way bills to track the movement of goods.

- Refunds: CBIC has taken several measures to streamline the refund process for taxpayers, including the introduction of a fully automated refund process and the establishment of a refund fortnight to expedite the refund process.

- GST Audit: CBIC has made it mandatory for taxpayers with a turnover of more than Rs. 5 crores to undergo an annual GST audit to ensure compliance with GST laws and to prevent tax evasion.

- GST Awareness Campaigns: CBIC has launched various campaigns and initiatives to create awareness among taxpayers about the benefits and procedures of GST. These campaigns aim to encourage taxpayers to comply with GST laws and to promote the ease of doing business in India.

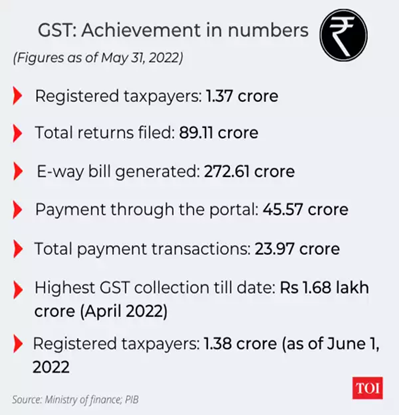

Data and Facts:

Source: TOI

Source: TOI

Source: TOI

Source: BusinessToday

Economic Survey: 2021

- GST has led to a 50% increase in the number of indirect taxpayers.

- GST has led to a 7% increase in the number of registered enterprises and a 30% increase in the number of taxpayers filing returns.

- GST has helped in reducing logistics costs and removing barriers to inter-state trade.

- GST has increased compliance and formalisation of the economy, which in turn has contributed to a reduction in tax evasion and an increase in tax collections.

- GST has helped in integrating the Indian economy into a single market and reducing economic distortions caused by inter-state variations in taxes.

- GST has had a positive impact on manufacturing and service sectors, with the latter benefiting more due to the removal of cascading taxes.

- The introduction of GST has led to a reduction in prices of goods and services, benefitting consumers.

Economic Survey: 2023

- GST led to high tax buoyancy, augurs well for resource mobilisation: Survey

- Goods and Services Tax collection is showing a higher buoyancy than the pre-GST system, auguring well for future resource mobilisation in the economy, the Economic Survey 2022-23 said.

- Giving a 5-year analysis of tax collection pre and post-GST, the survey said the taxes which were subsumed in the Goods and Services Tax had a buoyancy of one. However, the buoyancy improved to 1.1 after the GST implementation on July 1, 2017.

- “Improved tax collection efficiency was one of the main arguments in favour of GST. The evidence so far suggests that GST is indeed showing a higher buoyancy than the pre-GST system. This augurs well for future resource mobilisation in the economy,” said the Economic Survey.

How GST will help India’s Growth (5trillion-dollar economy):

The GST has had several positive impacts on the Indian economy. On the positive side, the GST has reduced the cascading effect of taxes, as businesses can claim input tax credits for taxes paid on their purchases and deduct them from their GST liability. This has resulted in lower prices for consumers and increased competitiveness for businesses. The GST has also streamlined the tax administration process, as businesses need to file only one tax return instead of multiple returns under the previous system. This has improved tax compliance and reduced the compliance costs for businesses.

Moreover, the GST has helped to formalize the economy by bringing more businesses into the tax net. This has increased the government’s tax revenue, which can be used to fund public infrastructure, social welfare schemes, and other developmental projects. The GST has also promoted the ease of doing business by reducing the paperwork and bureaucracy associated with tax compliance.

- Streamlining of Tax System: The introduction of GST has streamlined the tax system by replacing multiple taxes with a single tax, reducing the compliance cost for businesses, and making it easier to do business in India.

- Reduction in Tax Evasion: The GST system has been designed to reduce tax evasion by creating a trail of transactions, which makes it easier for tax authorities to identify discrepancies and plug tax leaks.

- Boost to Manufacturing and Exports: GST has helped to boost the manufacturing sector by providing tax credits for input taxes, which has resulted in a reduction in the cost of production. This has also made exports more competitive by reducing the incidence of taxes on exports.

- Ease of Starting a Business: GST has simplified the process of starting a business in India by reducing the number of registrations required and making it easier to obtain tax registration.

- Greater Transparency: GST has made the tax system more transparent by creating a system of electronic invoicing and providing real-time tracking of transactions, which has increased accountability and reduced corruption.

- Greater Tax Compliance: GST has made it easier for taxpayers to comply with tax regulations by providing a common platform for filing taxes, simplifying the tax payment process, and reducing the burden of compliance.

- Increased Revenue: GST has led to an increase in revenue for the government, which can be used to invest in infrastructure, education, and healthcare, and support the growth of the economy.

- Reduction in Prices: GST has resulted in a reduction in prices of goods and services due to the removal of cascading taxes and the input tax credit, which has made goods and services more affordable for consumers.

- Encouragement of Small and Medium Enterprises: GST has provided relief to small and medium enterprises by increasing the threshold for registration and providing a composition scheme for small taxpayers.

- Standardization of Tax Rates: GST has led to the standardization of tax rates across the country, reducing the variation in taxes between states and making it easier for businesses to operate across state borders.

Way Forward:

Here are some innovative measures that India can adopt to strengthen its GST regime, based on the best practices in other countries:

- Real-Time Invoice Reporting: Countries like Brazil and Mexico have implemented real-time invoice reporting systems, where businesses report their invoices to the tax authority in real-time. This reduces the risk of tax evasion and improves compliance. India can consider implementing a similar system to improve the accuracy and efficiency of GST reporting.

- Standardized Business Identification: Singapore has implemented a standardized business identification system, where businesses are assigned a unique identifier that is used for all tax-related transactions. This system ensures that businesses are easily identified and reduces errors in the tax reporting process. India can consider adopting a similar system to improve compliance and simplify the GST reporting process.

- Risk-Based Auditing: Canada and Australia have implemented a risk-based auditing system, where taxpayers are audited based on their risk profile. This system allows tax authorities to focus their resources on high-risk taxpayers and reduce the compliance burden on low-risk taxpayers. India can consider implementing a similar system to improve the efficiency of the GST audit process.

- Reduced Compliance Burden: Countries like New Zealand and Singapore have simplified their tax systems to reduce the compliance burden on businesses. For example, Singapore has implemented a simplified tax system for small businesses with a turnover of less than SGD 1 million. India can consider implementing similar measures to reduce the compliance burden on small businesses and encourage compliance.

- Digitalization: Estonia has implemented a fully digital tax system, where all tax-related transactions are conducted online. This system reduces the compliance burden on businesses and improves the efficiency of the tax administration. India can consider adopting similar digitalization measures to improve the accuracy and efficiency of GST reporting and administration.

Conclusion:

The GST is a crucial reform that will play a significant role in India’s economic growth. The CBIC’s reforms and innovative measures can further strengthen the GST regime, making it more efficient, transparent, and easier to comply with for taxpayers. The government’s commitment to improving the GST regime and promoting ease of doing business in India will not only attract more investments but also create more job opportunities, ultimately leading to the growth of the Indian economy towards its 5 trillion-dollar goal.

Author-

DR .B. RAMASWAMY

(AUTHOR & LEGAL EXPERT)

CHAIRPERSON (THE PRESIDING OFFICER ) STANDING ,APPELLATE COMMITTEE OF AICTE, GOVT OF INDIA.

SENIOR STANDING COUNSEL, MADRAS HIGH COURT FOR INCOME TAX DEPT, MINISTRY OF FINANCE, GOVT OF INDIA.

SENIOR STANDING COUNSEL – SUPREME COURT OF INDIA & DELHI HIGH COURT FOR EdCIL, MINISTRY OF EDUCATION, GOVT OF INDIA.

ADDL GOVT PLEADER (AGP) MADRAS HIGH COURT, FOR GOVT OF PUDUCHERRY.

For more Articles on GST like this, Subscribe now Taxonation.

Comment:

replies

replies