IN THE HIGH COURT OF JUDICATURE AT MADRAS

DATED: 05.08.2024

CORAM

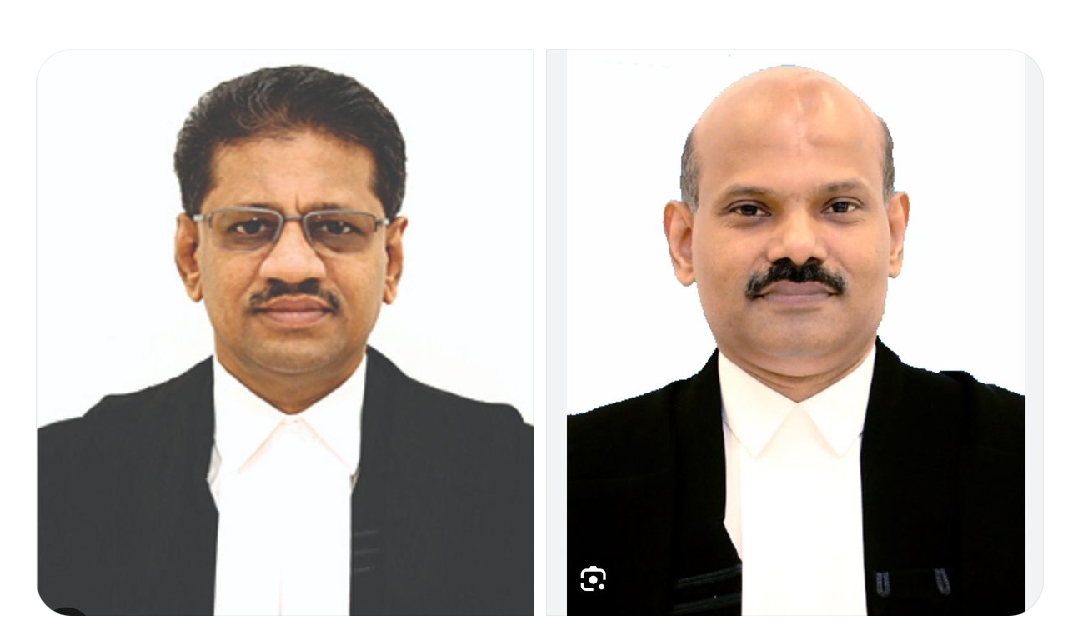

THE HON’BLE MR.JUSTICE R.SURESH KUMAR

AND

THE HON’BLE MR.JUSTICE C.SARAVANAN

Tax Case No.21 of 2024

The State of Tamil Nadu

Represented by the Joint Commissioner (CT) Coimbatore Division, Coimbatore. …. Petitioner

Vs.

Tvl.Marks Engineering Works

No.67/8, Athipalayam Road

Chinnavedampatty, Coimbatore. …. Respondent

Prayer : Tax Case Revision Petition under Section 60 of the TNVAT Act, 2006 to revise the order of the Tamil Nadu Sales Tax Appellate Tribunal (Additional Bench), Coimbatore dated 07.11.2023 passed in CTSA No.68 of 2018.

For Petitioner : Mr.Haja Nazimudeen Additional Advocate General-I assisted by Mr.G.Nanmaran Special Government Pleader

O R D E R

(Order of the Court was made by R.SURESH KUMAR, J.)

The issue raised in this revision is that, whether the appellate Tribunal was justified in reversing the Reverse Tax Credit of Rs.26,99,663/-.

- State being the petitioner represented by Mr.Haja Nazimudeen, Additional Advocate General-I would urge that, the issue is covered by a decision of the Coordinate Bench of this Court in the matter of State of Tamil Nadu and Another -vs- Everest Industries Limited (2022) 103 GSTR 10. Insofar as the law which has been settled by the Division Bench in Paragraph 126 of the judgment to state that, by virtue of the amendment that has been made by omitting Section 19(5)(c) of the Act, whether the intention of the Legislature was clear in allowing the Input Tax Credit for the inter-state sale to registered and unregistered dealers with retrospective effect was the question still to be answered.

- Learned Additional Advocate General has relied upon the Special Leave Petitions arising out of the aforesaid Division Bench order referred to supra in S.L.P.(D) No.5815 of 2023, where the Hon’ble Supreme Court, after having entertained the SLPs, has granted an interim order of stay of refund alone pursuant to the impugned order of the High Court until further orders.

- Though it was canvassed by the learned Additional Advocate General to show such indulgence by this Court, we are not impressed with the same. The reason being that, the law since has been declared by the Division Bench as stated in State of Tamil Nadu and Another -vs- Everest Industries Limited (2022) 103 GSTR 10, as cited supra, we respectfully follow the same.

Hence, this Tax Case fails and accordingly it is dismissed. No costs.

(R.S.K.,J.) (C.S.N.,J.)

05.08.2024

Index : Yes/No

Internet : Yes/No

KST

R.SURESH KUMAR, J. and

C.SARAVANAN, J.

KST

T.C.No.21 of 2024

05.08.2024