அதிரடி உத்தரவு Judge c saravanan. the Impugned Order is set aside and the case is remitted back to the respondents to pass a fresh order on merits and in accordance with law within a period of six (6) months from the date of receipt of a copy of this order. The Impugned Order which stands quashed shall be treated as a Draft Assessment Order/Show Cause Notice for the petitioner to respond to the same. Respondent shall make suitable arrangements in the portal to ensure the petitioner is able to upload the reply by giving prior notice to the petitioner. The respondent shall follow the procedure under Section 144B of the Income Tax Act, 1961. The writ petition stands disposed of with the above observations and directions. No cost. Consequently, connected miscellaneous petitions are closed. 05.09.2023 Index : Yes/No Speaking/Non-speaking Order Neutral Citation :Yes/No rgm C.SARAVANAN, J. rgm To The Income Tax Officer, National Faceless Assessment Centre, Income Tax Department, Ministry of Finance, Room No.401, 2nd Floor, E-Ramp, Jawaharlal Nehru Stadium, Delhi – 110 003. The Deputy Commissioner of Income Tax, Corporate Circle -1, Coimbatore-Main Building, 63, Race Course Road, Coimbatore – 641 018. The Principal Commissioner of Income Tax-1, 63, Race Course Road, Coimbatore – 641 018. W.P.No.9420 of 2022 and W.M.P.Nos.9166 & 9168 of 2022 05.09.2023

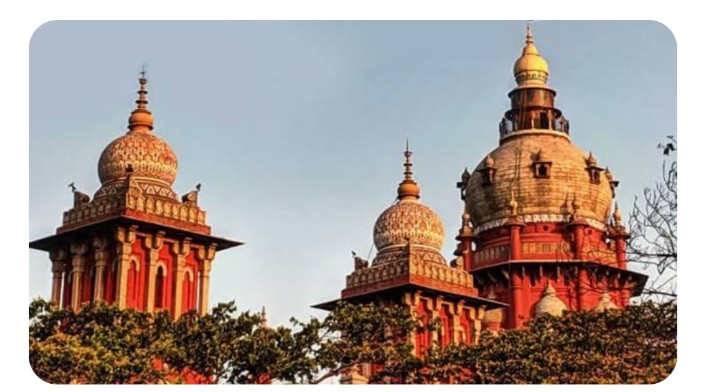

IN THE HIGH COURT OF JUDICATURE AT MADRAS

DATED : 05.09.2023

CORAM

THE HON’BLE MR.JUSTICE C.SARAVANAN

W.P.No.9420 of 2022 and

W.M.P.Nos.9166 & 9168 of 2022

Devendran Coal International Private Limited,

Represented by its Managing Director,

R.Rathnamala. … Petitioner

Vs.

- The Income Tax Officer,

National Faceless Assessment Centre,

Income Tax Department,

Ministry of Finance,

Room No.401, 2nd Floor, E-Ramp, Jawaharlal Nehru Stadium, Delhi – 110 003.

- The Deputy Commissioner of Income Tax,

Corporate Circle -1,

Coimbatore-Main Building, 63, Race Course Road, Coimbatore – 641 018.

- The Principal Commissioner of Income Tax-1,

63, Race Course Road,

Coimbatore – 641 018. … Respondents Prayer: Writ Petition filed under Article 226 of Constitution of India, for issuance of a Writ of Certiorari to call for the records in DIN:ITBA/AST/S/147/2021-22/1042145609(1) dated 30.03.2022 on the file of the first Respondent relating to A.Y.2017-18 and quash the same.

For Petitioner : G.Baskar

For Respondents : Mr.R.S.Balaji

Senior Standing Counsel

ORDER

The petitioner is aggrieved by the Impugned Assessment Order dated

30.03.2022. Earlier, the assessment was completed on 20.12.2019 under

Section 143(3) of the Income Tax Act, 1961 after the petitioner had filed a

Return of Income on 27.10.2017 under Section 139 of the Income Tax Act, 1961.

- During the period when the country was under lock down due to outbreak of Covid-19 pandemic, the Department had sought to reopen the assessment by issuing a notice under Section 148 of the Income Tax Act on

31.03.2021.

- The case of the petitioner is that petitioner has not received the notice although it would be the contention of the Department that the said notice was posted in a web portal and therefore it was for the petitioner to respond to the same.

- After the aforesaid notice was issued under Section 148 of the Income Tax, 1961 on 31.03.2021, the petitioner was also issued with the notice under Section 142 of the Income Tax Act, 1961 on 12.11.2021 to which the petitioner had replied and had also attempted to upload the return of income. Thereafter, the petitioner had successfully uploaded return of income pursuant to notice issued under Section 142(1) of the Income Tax Act, 1961 on 09.02.2022 and intimated the same to the respondents along with the second reply dated 09.02.2022.

- Thereafter, the respondents have also issued the reasons for reopening of the assessment on 17.03.2022. It was followed by a Show Cause

Notice dated 27.03.2022.

- The notice has been uploaded and sent to the petitioner at about 2.50 am on 28.03.2022 calling upon the petitioner to respond by 29.03.2022 by 23.59 Hours as the assessment was getting time barred on 30.03.2022.

- It is clear that the Impugned Order has been passed to ensure that the assessment does not get barred by limitation under Section 153 of the Income Tax Act, 1961. The procedure under Section 144B of the Income Tax Act, 1961, as in force between 01.04.2021 till 30.03.2022 was required to be followed. It has not been fully followed.

- In this case, no Draft Assessment Order has been passed by the

Assessing Unit as is contemplated under Section 144B of the Income Tax Act, 1961. Thus, there is a material violation of the procedure prescribed under Section 144B of the Income Tax Act, 1961.

- Consequently, the Impugned Order is set aside and the case is remitted back to the respondents to pass a fresh order on merits and in accordance with law within a period of six (6) months from the date of receipt of a copy of this order. The Impugned Order which stands quashed shall be treated as a Draft Assessment Order/Show Cause Notice for the petitioner to respond to the same. Respondent shall make suitable

arrangements in the portal to ensure the petitioner is able to upload the reply by giving prior notice to the petitioner. The respondent shall follow the procedure under Section 144B of the Income Tax Act, 1961.

- The writ petition stands disposed of with the above observations and directions. No cost. Consequently, connected miscellaneous petitions are closed.

05.09.2023

Index : Yes/No

Speaking/Non-speaking Order Neutral Citation :Yes/No

rgm

C.SARAVANAN, J.

rgm

To

- The Income Tax Officer,

National Faceless Assessment Centre,

Income Tax Department,

Ministry of Finance,

Room No.401, 2nd Floor, E-Ramp, Jawaharlal Nehru Stadium, Delhi – 110 003.

- The Deputy Commissioner of Income Tax,

Corporate Circle -1,

Coimbatore-Main Building, 63, Race Course Road, Coimbatore – 641 018.

- The Principal Commissioner of Income Tax-1, 63, Race Course Road, Coimbatore – 641 018.

W.P.No.9420 of 2022 and W.M.P.Nos.9166 & 9168 of 2022