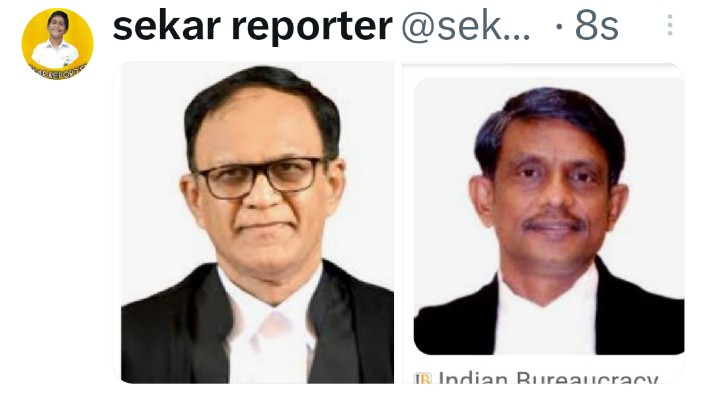

Alager kovil full order Judgment made by the Hon’ble Mr.Justice D.Bharatha Chakravarthy) THE HON’BLE MR.SANJAY V.GANGAPURWALA, CHIEF JUSTICEANDTHE HON’BLE MR.JUSTICE D.BHARATHA CHAKRAVARTHY

IN THE HIGH COURT OF JUDICATURE AT MADRAS

DATED : 05.03.2024

CORAM :

THE HON’BLE MR.SANJAY V.GANGAPURWALA, CHIEF JUSTICE

AND

THE HON’BLE MR.JUSTICE D.BHARATHA CHAKRAVARTHY

Writ Appeal Nos.2487, 2054 and 2432 of 2023

In W.A.No.2487 of 2023 :

- P.Adiakappan Chettiar

- A.Valliyappan

- R.M.Sulochana

- C.Pavankumar Bhangal

- P.Ramkumar

- P.Sushil Kumar .. Appellants

Versus - The Executive Officer,

Arulmighu Kallalagar Devasthanam Alagarkoil,

Madurai. - The District Collector,

Madurai District,

Madurai. - The Revenue Divisional Officer,

Madurai.

S.R.Lakshmana Bhattar (died) - P.Paramasivam

- S.Diraviyam Pillal

- Sundaraswamy

- N.Subramaniyan

- K.Chithan

- N.Arumugam

- Sakunthala Devi

- N.A.Asraof Ali

- Nagammal Achi

- S.Manimekalai

- T.Gajalakshmi

- N.Mohammed Feroz Khan

- S.S.Rajan

- R.Florence

- Farook

- A.Premaleelavathi

- N.Feroz Noor Mohammed

- M.Saroja

- V.M.Sathish Kumar

- V.M.Thiruvengadasamy

- V.M.Sanjay Kumar

- R.Jayashri Golani

- S.Pownraj

- P.Adaikkan Chettiar

- N.N.Kannappan

- L.Fakruddin

- M.Salim

- S.Jaffar Salim

- A.Ramalakshmi

- Ahmed Ibrahim

- B.Saravanan

- C.Srinivasan

- R.Salim

- T.Amalraj

- S.R.Padma

- S.R.L.Rangarajan

- The Commissioner,

The Hindus Religious and Charitable Endowments

Department, (HR and CE),

Nungambakkam High Road, Chennai – 600 034.

R40 is impleaded vide order of this Court,

dated 07.09.2023 made in W.A.No.2487 of 2023 .. Respondents

In W.A.No.2054 of 2023 :

- S.Manimekalai Achi

- M.Saroja

- B.Saravanan .. Appellants

Versus - The Executive Officer,

A/m. Kallalagar Devasthanam,

Alagarkoil,

Madurai. - The District Collector,

Madurai District,

Madurai. - The Revenue Divisional Officer,

Madurai.

S.R.Lakshmana Bhattar (died)

- P.Paramasivam

- S.Diraviyam Pillai

- S.Sundaraswamy

- N.Subramaniyan

- K.Chithan

- N.Arumugam

- Sakunthala Devi

- N.A.Asraof Ali

- P.Adaikappan Chettiar

- Nagammai Achi

- T.Gajalakshmi

- N.Mohammed Feroz Khan

- S.S.Rajan

- R.Florence

- Farook

- A.Valliyappan

- R.M.Sulochana

- A.Premaleelavathi

- C.Pavankumar Bhangal

- N.Feroz Noor Mohammed

- V.M.Sathish Kumar

- V.M.Thiruvengadasamy

- V.M.Sanjay Kumar

- R.Jayashri Golani

- S.Pownraj

- P.Adaikkan Chettiar

- P.Ramkumar

- P.Sushil Kumar

- N.N.Kannappan

- I.Fakruddin

- M.Salim

- S.Jaffar Salim

- A.Ramalakshmi

- Ahmed Ibrahim

- C.Srinivasan

- R.Salim

- T.Amalraj

- S.R.Padma

- S.R.L.Rangarajan

- The Commissioner,

HR and CE Department,

Nungambakkam High Road,

Chennai – 600 034.

R43 is impleaded vide order of this Court,

dated 07.09.2023 made in C.M.P.No.20591 of 2023

in W.A.No.2054 of 2023 .. Respondents

In W.A.No.2432 of 2023 :

- S.R.Padma

- S.R.L.Sri Rangarajan .. Appellants

Versus - The Executive Officer,

A/m. Kallalagar Devasthanam,

Alagarkoil, Madurai. - The District Collector,

Madurai District,

Madurai. - The Revenue Divisional Officer,

Madurai.

S.R.Lakshmana Bhattar (died)

- P.Paramasivam

- S.Diraviyam Pillal

- S.Sundaraswamy

- N.Subramaniyan

- K.Chithan

- N.Arumugam

- Sakunthala Devi

- N.A.Asraof Ali

- P.Adaikappan Chettiar

- Nagammai Achi

- S.Manimekalai Achi

- T.Gajalakshmi

- N.Mohammed Feroz Khan

- S.S.Rajan

- R.Florence

- Farook

- A.Valliyappan

- R.M.Sulochana

- A.Premaleelavathi

- C.Pavankumar Bhangal

- N.Feroz Noor Mohammed

- M.Saroja

- V.M.Sathish Kumar

- V.M.Thiruvengadasamy

- V.M.Sanjay Kumar

- R.Jayashri Golani

- S.Pownraj

- P.Adaikkan Chettiar

- P.Ramkumar

- P.Sushil Kumar

- N.N.Kannappan

- I.Fakruddin

- M.Salim

- S.Jaffar Salim

- A.Ramalakshmi

- Ahmed Ibrahim

- P.Saravanan

- C.Srinivasan

- R.Salim

- T.Amalraj

- The Commissioner,

Hindu Religious and Charitable Endowments

Department (HR and CE),

Nungambakkam High Road,

Chennai – 600 034.

R44 is impleaded vide order of Court,

dated 07.09.2023 made in W.A.No.2432 of 2023,

W.A.No.2487 of 2023 etc. .. Respondents

Common Prayer: Writ Appeals filed under Clause 15 of the Letters Patent to set aside the impugned order dated 21.04.2023 in W.P.No.7775 of 2023.

For the Appellant : Mr.V.Raghavachari, Senior Counsel

(in all the cases) for M/s.Karthika Ashok

For the Respondents : Mr.A.K.Sriram, Senior Counsel

(in all the cases) for Mr.P.Gopalan, for R1

: Mr.A.Edwin Prabakar,

State Government Pleader for the State

: Mr.N.R.R.Arun Natarajan,

Spl. Government Pleader

for HR & CE Department

C O M M O N J U D G M E N T

(Judgment made by the Hon’ble Mr.Justice D.Bharatha Chakravarthy)

A. The Petitions:

These Writ Appeals arise out of the Order of the learned Single Judge dated 21.04.2023 in W.P.No.7775 of 2003 and as such are taken up together and disposed of by this Common Order.

- In the Writ Petition, the Executive Officer, Arulmighu Kallazhagar Devasthanam, Azhagarkoil, Madurai (hereinafter ‘the temple’), is the writ petitioner. The order of the District Collector, Madurai dated 16.10.2022 bearing reference in R.O.C.J2/91317/2001 was challenged in the Writ Petition. By the said impugned order, the District Collector set aside the order of the Revenue Divisional Officer, Madurai(hereinafter ‘the RDO’), dated 15.06.2001, holding that the very entertainment of the petition for resumption of property mentioned therein is without jurisdiction.

2.1. The RDO had passed an order dated 15.06.2001 in the application filed by the Executive Officer of the temple, under Section 21 (7) (b) of the Tamil Nadu Minor Inam (Abolition and conversion into Ryotwari) Act, 1963 (Act 30 of 1963), read with Rule 19 of the Tamil Nadu Minor Inam Rules 1965 and Section 41 of the Tamil Nadu Hindu Religious Endowments Act 1959 (Act 22 of 1959).

2.2. In the said application, before the RDO, it is the claim of the temple that the predecessors of the appellants herein through whom the appellants are claiming title, were the Archakas providing Bhattar service to the temple. The temple is the ultimate owner of the property and the said Archakas were only granted a service inam i.e., the right to enjoy the property so long as they render service to the temple. It is a right attached to the Office and not an individual right. The moment they violated the condition and alienated the property the temple is entitled to resume the property under Section 41 of the Tamil Nadu Hindu Religious Endowments Act 1959 Act (hereinafter referred to as ‘the HR&CE Act’),and accordingly the application was made.

B. The Factual Background:

- The factual matrix, on which this case arises is as follows:-

The subject matter property are nanja lands in Survey No.26, Melamadai Village, Madurai Taluk, ad-measuring 1 acre and 83 cents. Admittedly, the said Melamadai Village is an inam village. After the Tamil Nadu Minor Inams (Abolition and Conversion into Ryotwari) Act, 1963 ( hereinafter ‘the Act 30 of 1963’) came into force, as per Section 3 of the said Act, the land would stand vested with the Government, unless Ryotwari patta is granted as per Section 8 of the Act. There was no initial claim before the Settlement Officer, in respect of the land in question. The Settlement Officer therefore, took up suo-motu enquiry under Section 11 of the Act 30 of 1963.

3.1 During the enquiry, one Pappammal, Venkataraman and Muthalagu Konar claimed that they are entitled to kudiwaram rights in respect of the said lands. It is claimed that Mr.Venkataraman’s father and his paternal uncle had purchased an extent of 91 cents of the land in Survey No.26 in a Court auction. The remaining extent of 93 cents was purchased by Muthalagu Konar from the original owner of the kudiwaram under a sale deed dated 14.08.1947. It is their contention that the Devasthanam as well as the Archakas were only the holders of melwaram alone, therefore, they had claimed Ryotwari Patta. The Settlement Officer, viz., the Settlement Tahsildar No.I, M.I. (Madurai) in S.R.No.1146/MI Act/MDU/66 dated 18.09.1971 had granted Ryotwari patta in favour of the said Pappammal and two others. Aggrieved by the same, S.R.Lakshmana Bhattar and Alangara Bhattar @ Paramasamy Bhattar filed an appeal before the Inam Abolition Tribunal / the Principal Subordinate Judge, Madurai in C.M.A.No.373 of 1972. In the said appeal, the temple was arrayed as 4th respondent. After detailed enquiry, by a Judgment dated 31.08.1976, the Tribunal allowed the appeal. The Tribunal framed the following two questions:-

“5. The following main points arise for consideration in this appeal :-

(1) Whether the grant was in respect of iruwaram as contended by the appellants as well as by the 4th respondent -Devasthanam or whether it was in respect of melwaram alone as pleaded by the respondents 1 to 3 herein.

(2) As among the parties, who are entitled for ryotwari patta in respect of the lands in question.”

3.2. Upon consideration of the documents and the various entries contained in the Inam Register, the Tribunal found in paragraph 7 of the judgment that there can be no doubt whatsoever that the grant in the present case was iruwaram (both warams) and not of melwaram alone. The Tribunal, further proceeded to consider the question as between the service holders viz., the Bhattars and the Devasthanam and held as follows in paragraph No.10:-

“10. …………………the only question would be as between the service-holders, namely, the appellants herein and the Devasthanam, that is 4th respondent, who is entitled for ryotwari patta. It has not been disputed by the Devasthanam that the appellants are the descendants of the service holders. But the main contention that has been advanced on behalf of the Devasthanam is that the service holders have alienated the said inam lands; but, I most straight away point out that there is absolutely no evidence on the side of the Devasthanam to show as to whether any alienation has been effect by anyone of the service holders. The evidence would also go to show that the appellants have been maintaining the archaka service in the said temple and consequently, it is only the appellants that would be entitled for ryotwari patta in respect of the said lands under Sec. 8(1) of the Act subject to the provisions of Sec. 21 of the Act, namely, they should continue to render the archaka service in the said temple. This point is accordingly answered.”

3.3. Aggrieved thereby, the said Pappammal and others approached the Appellate Tribunal in STA No.277 of 1976 under Section 30 of the Inam Abolition Act. The matter came to be considered by the co-ordinate Division Bench of this Court. The Division Bench after considering the evidence on record, made the following findings,

“The combined effect of all these documents is the following:

1)That the inam was Devadayam, for the purpose of archanai service in kallalaghar temple;

2)That the persons who were performing the service at the time of confirmation of the inam were Sesha Bhattar and Muthusundararaja Bhattar;

3)That it was in favour of those two persons the title deed had been issued; and

4)That the confirmation of the inam had been made under rule III Clause II, free, in view of the fact that the name of the grantor and the year in which the grant was made were not known.”

3.4. The Division Bench found that the documents established that the subject matter was grant of both the warams and not melwaram only. The Division Bench found as follows:-

“………………….The inam being for the performance of archaka service, it will go with the office and whoever occupies the office of archaka alone will be entitled to enjoy the property.”

3.5. The Division Bench further held as follows:-

“……………We are not able to appreciate their arguments, because we are not concerned with the family in the present case but we are concerned only with the office of Archaka and the persons who perform the Archaka service. If that aspect is remembered, there is no question of relying upon Ex.B.5 for the purpose of contending that the Archakas themselves had dealt with the property on the basis that they owned only the melwaram in the land in question.”

3.6. Finally, the Division Bench held that in view of the above findings, it cannot uphold the case of the appellant on the basis that the Archakas themselves claimed melwaram right alone and the appeal was disposed of on the following terms:-

“………..For these reasons, we agree with the conclusion of the Tribunal and dismiss the appeal. There will be no order as to costs.”

C. The Case of the Parties :

3.7. In the year 1984, the 1st respondent in the above appeal – S.R.Lakshmana Bhattar executes and registers an exchange deed, exchanging his own property comprised in Survey Nos.132/8, 135/4, 133/5, 149/7, Kuruthur Village, Madurai North Taluk, Thamaraipatti Sub Registration District, Madurai District, to that of the subject matter property. The english translation of the preamble portion of the exchange deed reads as follows:-

“This deed of exchange is executed between

S.R.Lakshmana Buttar, son of Srirengaraja Buttar alias Paramasamy Buttar, residing at Door No.3, Perumal Kovil Street, Thallakulam, Madurai Town as party of the FIRST PART and

S.R.Lakshmana Buttar, representative of Archaga Service, for the Archaga Service of Sri Kallagar Temple, Alagar Temple, Melur Taluk, as party of the SECOND PART both of us executes this deed of exchange.”

The recitals of the said deed reads as follows:-

“WHEREAS I am doing archaga service at Sri Kallagar Temple Madurai. Towards the same, patta for the land situated at Survey No.26, Melamadal Village, Madurai Taluk, to an extent of Acre 1 Cents 83 given to me as per Inam Abolition Act and I am enjoying it. There is no income from the said land. As the said land was asked for a good sale consideration, I thought of selling it and from the sale consideration, I shall exchange a property from which income shall be derived profitably. There are properties in the ‘A’ Schedule hereunder that belongs to me which derive good income. The ‘B’ Schedule was conveyed. So I had an opinion to use the ‘A’ Schedule property for the income of the Archakas. When compared to the lands in Melamadai, the lands In ‘A’ Schedule will given permanent quality income. Hence instead of the lands in ‘A’ Schedule will give permanent income to the archaga service. So since I exchanged the lands in ‘A’ Schedule instead of the lands of Melamadai in ‘B’ Schedule for the purpose of income deriving lands for the Sri Alagar Temple Archaga Service, hence as being enjoyed the Melamadai land that is ‘B’ Schedule properties as the Archaga Service rights, henceforth I will enjoy the “A” Schedule Property similarly.”

3.8. Thereafter, the said S.R.Lakshmana Bhattar by his letter dated 20.12.1984 addressed to the Commissioner, HR & CE Department, apologized for his conduct and stated that subsequently, he came to know that he need to get the approval of the Commissioner for the said exchange and accordingly, prayed for an approval. The translation of the relevant portion of the letter reads as follows:-

“Hence, I had exchanged the nanja land belonged to me in an extent of Acre 2, Cent 2 at Kuruthur Village, Madurai Taluk as exchanged property and registered it in the year 1984. These lands are lands that would give high yield. I don’t know that I should apply to Maha.La.La. Sri Commissioner and obtain order. Now only I came to know about it.

Hence I request the Maha.La.La.Sri Commissioner to kindly forgive me and to issue order recognizing the Kuruthur Village lands (Acre 2 Cents 2) as grant lands instead of the exchanged property of Melamadai lands and to pass orders for selling the land in Melamadai Village land Acre 1 Cents 83.”

3.9. Thereafter, in the year 1988, the temple also passes a resolution recognising and approving the said exchange and alienation. Pursuant thereof, on 07.12.1988, the temple also addresses the Commissioner, HR & CE Department, for grant of approval in respect of the said transaction. By a communication dated 03.01.1989, the Deputy Commissioner of HR & CE Department, Madurai, forwards the said request along with his recommendation that the transaction can be approved by the Commissioner. On 23/12/1989, once again the Assistant Commissioner of the temple also writes to the Deputy Commissioner, forwarding the necessary documents. Thereafter, the Committee of the temple in its meeting on 10.05.1991 held that in respect of the said exchange of service inam lands, formal permission from the Commissioner should be obtained, and in respect of other lands sold by Alangara Bhattar @ Paramasamy Bhattar, legal action should be pursued. It is in these circumstances, on 05.09.1993, a Resumption Petition was filed before the RDO, Madurai, under Section 21 (7) (b) of the Tamil Nadu Minor Inam (Abolition and conversion into Ryotwari) Act 30 of 1963 read with Section 41 of the Tamil Nadu Hindu Religious Endowments Act 1959 (Act 22 of 1959).

3.10. It is the contention of the temple that service inam is attached to the Office will be valid so long as the grantee continues to render the Archaka service. After the grantee, his legal heirs also can claim the benefit of possession of the property, if they continue the Archaka service to the temple. The lands are inalienable lands. Once the Bhattars have sold and alienated the lands with a view to defeat the valid claim of the temple, the lands are liable to be resumed and hence the petition.

3.11. The petition was filed against S.R.Lakshmana Bhattar and 28 others, who are the subsequent alienees. The said S.R.Lakshmana Bhattar resisted the petition by filing detailed counter affidavit. It is his contention that in the settlement proceedings patta was ultimately granted in his favour and the same was affirmed by the Appellate Tribunal in S.T.A.No.277 of 1976. The only condition imposed was that the respondent should continue to render his service. The service has been rendered continuously. Resumption can be prayed under Section 21 (7) (b), if only the respondents failed to render service. The lands were properly exchanged and the temple has accepted the same and forwarded the same for acceptance by the Commissioner also. Thus, the respondent, as a service holder was given the right of the land permanently. After grant of Ryotwari patta and there is no embargo on the service holder from transferring or alienating the lands. It must be seen that they have been granted patta under Section 8 (1) read with Section 21 of the Act 30 of 1963 and therefore, the claim of the temple as if patta under Section 8 (2) (ii) read with Section 21 of the Act 30 of 1963 is incorrect in law. The Judgment of the Abolition Tribunal and Appellate Tribunal having become final, the exercise of power under Section 34 or 41 of the HR&CE Act are absolutely wrong and unsustainable.

3.12. After, due enquiry, the RDO passed an order on 21.11.1994. The RDO found that the land has been in possession of the said S.R.Lakshmana Bhattar and his subsequent alienees. Ryotwari patta has been granted under Section 8 (1) of the Act 30 of 1963 in favour of the 1st respondent, service holder and not in favour of the temple. The service holder continues to render the Archaka service in the temple. The Act does not prohibit the transfer of the property by the service holder. Therefore, the respondents on the basis of their title are the owners of the land and the land is thus not resumable under Section 41 of the Act. Holding so, the RDO dismissed the petition.

3.13. Aggrieved by the same, an appeal was laid before the District Collector. The said order was set aside and once again the matter was remanded back to the RDO. The RDO held that the declaration under Section 21 (7) (b) of the Act 30 of 1963 can be made only when there is failure of service to the instant institution. When S.R.Lakshmana Bhattar has proved that there is no failure in rendering Archaka service in the petitioner Temple, then under Section 21 (7) (e) of the Act 30 of 1963, he is entitled to occupy the lands. As far as the claim under Section 41 of the Act is concerned, the HR & CE Department is the authority concerned to deal with the ratification approval of exchange of lands. Holding so, the petition was dismissed.

3.14. As against the said order, an appeal was filed to the District Collector. By the order impugned in the Writ Petition dated 16.10.2002, the appeal was disposed of with a direction to approach the competent Civil Court. The Appellate Authority, viz., the District Collector framed the following three issues,

“(1) Whether a ryotwari patta granted to a service holder under section 21(7)(a) of the Act 30/1963 conveys to him absolute alienable rights?

(2) Whether the Revenue Divisional Officer is competent to resume the lands in case of alienation of the property?

(3) Whether the provisions of section 41 of the Act 22/1959 can be applied in this case?

3.15. The District Collector answered the issue No.1 that the Ryotwari patta granted under Section 21 (7) (a) does not convey absolute alienable rights to the grantee. The District Collector answered the issue No.2 that the RDO is endowed with a limited jurisdiction only to the extent of whether the service holders continue to render the service or not and does not have the power to resume the lands to the Institution concerned. On the issue No.3, the District Collector found that the provisions under Section 41 of the Act, the Collector can exercise powers only in respect of the service inam lands which continue to be inam and not in respect of the lands which has already been converted into ryotwari. The District Collector further held that since without any alienable rights, the property has been alienated, the matter has to be decided only by the competent authority and accordingly, while setting aside the order of the RDO, the District Collector dismissed the petition for resumption with a liberty to agitate the issue before the competent Civil Court.

3.16. Challenging the said order, the present Writ Petition is filed. The Writ Petition is resisted on the same lines. The learned Single Judge by the Order dated 21.04.2023 considered the issue. After considering the Section 41 of the Act, the learned Single Judge found that the District Collector is the competent authority who is empowered to initiate action on the application of the trustee of the religious institution.

3.17. It is found that there is no absolute alienable right. The sale executed by the Archaka concerned is void ab initio. The Collector erred in holding that the petition is not maintainable under Section 41. Similarly, the order of the RDO is also erroneous. The exchange was not made with the permission of the Commissioner of HR & CE Department. The fit person was not entitled to pass a resolution favouring the exchange. Accordingly, the learned Single Judge set aside the order of the District Collector dated 16.10.2002 and the order of the RDO dated 15.06.2001 and directed the 1st respondent viz., the District Collector, to resume the lands in question in favour of the temple, by evicting the occupants, within a period eight weeks from the date of receipt of that order. Aggrieved by the same, the present Writ Appeal is filed.

- Heard, Mr.V.Raghavachari, learned Senior Counsel appearing on behalf of the appellants; Mr.A.K.Sriram, learned Senior Counsel appearing on behalf of the 1st respondent; Mr.Edwin Prabakar, learned State Government Pleader appearing for the State and Mr.N.R.R.Arun Natarajan, learned Special Government Pleader appearing on behalf of the HR & CE Department.

D. The Arguments :

- Mr.V.Raghavachari, learned Senior Counsel taking this Court to the order of the learned Single Judge would submit that the finding of the learned Single Judge that the title deeds stand in the name of the Deity of the temple and therefore, the Deity is the owner of the property is erroneous. He would submit that the parties would be bound by the final orders that are passed in the settlement proceedings. Admittedly, the property comes under the Inam Village and therefore, as per Act 30 of 1963 once Ryotwari patta is granted by the settlement authority, it would vest in the person in whose favour, the Ryotwari patta is granted. In the instance case, the temple never claimed any Ryotwari patta before the Settlement Officer. As a matter of fact, the Settlement Officer took up suo motu enquiry which was only a rival claim between two sets of individuals, even though the temple was a party. Ultimately, it must be seen that when Ryotwari patta was granted in favour of one Pappammal and two others by the settlement officer, the temple did not file any appeal. It is only S.R.Lakshmana Bhattar and Alangara Bhattar @ Paramasamy Bhattar who filed appeal before the Inam Abolition Tribunal. After a detailed enquiry, the Inam Abolition Tribunal ultimately ordered that Ryotwari patta in respect of the lands in question to be issued in favour of the appellants therein i.e., S.R.Lakshmana Bhattar and Alangara Bhattar @ Paramasamy Bhattar, under Section 8 (1) of the Act subject to the condition that as per Section 21 of the Act, they should continue to render Archaka service in the said temple. Upon further appeal to the Appellate Tribunal, a co-ordinate Bench of this Court ultimately confirmed the order of the Tribunal and as such Ryotwari patta has been granted in favour of the appellants therein under Section 8 (1) of the Act.

5.1. Mr. Raghavachari, would contend that a bare perusal of Section 8 (1) of the Act, it would be clear that Ryotwari patta will be issued if only concerned individuals had kudiwaram. Therefore, when the Ryotwari patta was granted to the appellants and the same so far not been questioned by the temple, the matter has become final. Once Ryotwari patta is granted, the lands are very much alienable. There is no impediment whatsoever for the same, so long as the Archaka service is being rendered for the temple.

5.2. In support of his submissions, the learned Senior Counsel would rely upon the Judgment of this Court in Executive Officer, Sri Ranganathaswamy etc., Devasthanam, Srirangam Vs. The Commissioner of Land Administration, Madras,1 more particularly to paragraph Nos.10 to 14 therein and would submit that at best the temple would only be entitled for dastik allowance as it will be clear that it was only entitled to melwaram. The learned Senior Counsel would rely upon the Judgment of the Hon’ble Supreme Court in P.V.Bheemsena Rao Vs. Sirigiri Pedda Yella Reddi and Ors.2, to contend that the nature of personal inam burdened with service is that it is meant for the individual to whom it is granted, though he is required to perform the service to the temple, and therefore such lands cannot be resumed under Section 44 of the erstwhile Madras Hindu Religious Endowments Act, 1927.

5.3. The learned Senior Counsel would further submit that it can be clear from the records that even the temple never opposed to the exchange and as a matter of fact, recommended the same to the Commissioner. When the same has not been rejected by the Commissioner by virtue of efflux of such a long period of time, the learned Single Judge ought not to have issued the directions to resume the property.

5.4. Mr. Raghavachari, would contend that in any event, the Civil Court will also have the jurisdiction to determine the respective rights of the parties and the Collector has rightly relegated the parties to approach the Civil Court. Only the Civil Court can examine the respective rights of the parties and can decide about the nature of the property and it’s title thereof and it cannot be decided in the Writ jurisdiction more specifically in any enquiry, relating to resumption under Section 41 of the Act. Therefore, he would pray that the appeals be allowed.

- Per contra, Mr.A.K.Sriram, learned Senior Counsel appearing for the temple, would take this Court through the order of the Inam Abolition Tribunal and the Division Bench Judgment of this Court in the appeal. He would submit that there has been categorical findings by this Court that the inam is a service inam / Devadhayam. It is for the purpose of archanai service in the temple. The inam will go with the office and whoever occupies the office of the Archaka will be entitled to enjoy the property. It is not a personal inam, but attached to the office. The temple was found to be entitled in respect of the both warams. When the specific issues have been considered and express findings have been arrived at, the same has to be duly taken into consideration and merely because Appellate Tribunal affirmed the Judgment in appeal, in which by mistake mentioned that Ryotwari patta is being granted under Section 8 (1) instead of Section 8 (2) of Act 30 of 1963, the same by itself would not in any manner alter the nature of the land or its title. It is the temple, which has title to the properties. Whoever was the Archaka performing the archanai service in the temple was entitled for the right of possession and enjoyment of the property. They absolutely have no right whatsoever to alienate the property. The alienation was not done with the permission of the Commissioner of HR & CE Department. Therefore, the temple is entitled to pray for resumption under Section 41 of the Act. As a matter of fact, Section 41 clearly takes care of various provisions of Inam Abolition Act and specifically considers the issue relating to the service inams.

6.1. Mr. A.K. Sriram, would submit that if the submission of the learned Senior Counsel for the appellants is to be considered then that would tantamount to the temple being permanently divested of its title. It is not the case that the temple was entitled for melwaram alone. In such a case, it is not the S.R.Lakshmana Bhattar and Alangara Bhattar @ Paramasamy Bhattar, but patta would have been granted to Pappammal and two others and they were the tillers of the soil. Only because both warams were granted in favour of the temple, the Ryotwari patta itself was ordered to be issued in the name of the Bhattars. Both the Tribunal as well as the Appellate Tribunal have specifically found that it is a service inam. That being the position, the same is not alienable. In support of his submissions, the learned Senior Counsel would rely upon the Judgment of the co-ordinate Bench of this Court in Narayanasamy Dasari and another Vs. The Commissioner for Hindu Religious and Charitable Endowments, Madras in Appeal No.80 of 1964 dated 28.07.1970, to contend that any inam granted to an Archaka, service holder or other employee of the religious institution for the performance of any service or charity or connected with the religious institution shall not be deemed to be a personal gift to the Archaka, service holder or the employee, but shall be deemed to be a religious endowments.

6.2. The learned Senior Counsel would rely upon the Judgment of the Supreme Court in Sankaranarayana Swami Devasthanam Vs. P.S.Chandrasekara Raja in Civil Appeal No.2671 of 2013, to contend that once a grant is burdened with the service, then the right of resumption under Section 21 (7) of the Act is always there. The sale deeds cannot take away the statutory right of the appellant temple to resume the land. The learned Senior Counsel would rely upon the Judgment of the learned Single Judge of this Court in V.E.Ramanathan Chettiar Vs. Kalidasa Kavandan and Anr3., to contend that if alienation of a temple service inam land is such that it would lead to the loss or deprivation of the property to the temple, it must be held to be invalid.

6.3. The learned Senior Counsel also placed reliance on the Judgment of this Court in Neti Anjaneyulu Vs. Sri Venugopala Rice Mill4, to contend that if the properties were sold, the purchaser would get no title of any value and thus the Government can resume possession of charitable or religious inam immediately on alienation. The learned Senior Counsel would further rely on the Constitution Bench Judgement of the Supreme Court of India in Roman Catholic Mission Vs. State of Madras & Anr.5, to contend that if the Bhattars are granted with the lands for the performance of service of the temple, it could not mean that the inam was a personal inam, it would only be a Devathayam inam and as such it is the temple, who is the owner of the property. Evidently, if the alienation is done without the permission of the Commissioner, by virtue of Section 41 of the Act, irrespective of continuance of performance of the service, the land is liable to be resumed and therefore, there is no error whatsoever in the order of the learned Single Judge.

6.4. Also supporting the submissions of the learned counsel for the temple, Mr.N.R.R.Arun Natarajan, the learned Special Government Pleader would place reliance on the Judgment of the Hon’ble Supreme Court of India in Subramania Gurukkal (dead) through Muthusubramanis Gurukkal and Ors., Vs. Shri Patteswaraswami Devasthanam, Perur, by its Executive Officer and Ors6., to contend that on the basis of the evidence on record, it would be clear that the grant is with reference to an institution and not to an individual. In that case also identical entry column No.10 in the Inam Register was considered to support the view that the grant is in favour of the Devasthanam. He would further rely upon the Judgment of the Hon’ble Supreme Court of India in State of Madhya Pradesh and Ors., Vs. Pujari Utthan Avam Kalyan Samiti and Anr.7, to contend that the rights which are granted to the priests or Pujaris would not divest the title of the deity. For the proposition that the patta must be deemed to have been given in favour of the temple, which is only represented by the service holders, he would rely upon the Judgment of this Court in S.Sarojini Vs. The Addl. Chief Secretary, Commissioner of Land Administration in W.A.No.2581 of 2022 dated 23.01.2023.

E. The Questions:

- We have considered the rival submissions made on either side and perused the material records of the case. The questions which arise for determination in the present case are, (I) Whether the Archakas, having been issued Ryotwari Patta, are entitled to alienate the properties as they continue to the render bhattar service to the temple ? (II) Whether the collector is empowered under Section 41 of the HR & CE Act to resume the land on application from the temple ?

Question No. I: - Admittedly, the land is a minor inam land, dealt with under Act 30 of 1963. Before adverting to the facts of the instant case, it is necessary to bear in mind the basic concept of Inam. Historically, in our Country, in general, and Tamilnadu in particular, the State had the prerogative right to the royal share of the produce from all occupied and cultiaved lands, which upon being commuted into money value being the rent or land revenue. Broadly, the revenue settlement in India came under three categories, the Zamindarai, Ryotwari and Inam. In satisfaction of the payments due to from the State or where the value assessed of the lands exceeds, after collecting the such excess called Jodi or quit-rent, the State makes grant. Such payments by the State were known as Inams and the lands given in lieu thereof were Inam lands. However, the terms ‘Inam’, ‘Inamdar’ etc., came to be defined under the statutes in a varied manner so as to suit the purposes of the particular statute. As far as the present statute, Act 30 of 1963 , Section 2 (5) defines Inam, which reads as follows :

“(5) “inam” means —

(i) a grant of melvaram in any inam land; or

(ii) a grant of both the melvaram and the kudiwaram in an inam land which the grant has been made, confirmed or recognised by the Government”

‘Melwaram’ is the royal share of the produce or rent commuted into its money value. A grant of melwaram means an assignment of land revenue-assessment due to the State, thus termed as the inams. ‘Kudiwaram’ is the cultivator’s share of the produce, that is, the right of tiller of the soil in the lands1.

8.1. Now, adverting the facts of the present case, originally when third parties viz., Pappammal and two others claimed Ryotwari patta under Section 8 (1) of the Act for the lands in question, the stand taken by both the Archakas, viz., S.R.Lakshmana Bhattar and Alangara Bhattar @ Paramasamy Bhattar was that they along with the temple was entitled to both warams. If it has been pleaded that the temple was entitled only to melwaram in the settlement proceedings and that the same was only assigned to their benefit for the Archaka service rendered by them, then the said Pappammal and two others would have been granted the Ryotwari patta and the temple or the Archakas would have only been compensated by dastik allowance. But the contention was that both the warams vested with them. The said contention found favour of the Tribunal and on appeal, the findings of the appellate Tribunal which are extracted above is very clear that the inam was a Devadhayam, i.e., for the purpose of archanai service in Kallalagar Temple.

8.2. The name of the individuals who are performing the service at the time of confirmation of inam was entered into the register. It is categorically found that the subject matter of the grant was both the warams and not melwaram alone. It is the further pointed out that the inam is for the performance of Archaka service and it will go with the office and whoever occupies the office of the Archaka alone will be entitled to enjoy the property. The said order of the co-ordinate Bench of this Court, has become final and has not been assailed by any parties either by approaching higher fora or by filing any civil suit to establish any title to the contrary.

8.3. In that view of the matter, when throughout the Judgment, it is the categorical finding of the Appellate Tribunal that both the warams would vest with the temple, and that the individuals’ names are entered in the register because the fact they being Archakas at the relevant time, the same cannot be ignored, only for the reason that in the final sentence of the order, the order merely said that the appeal stands dismissed, without correcting the obvious mistake in the order of the Inam Abolition Tribunal, in the operative portion that the Ryotwari patta to be issued under Section 8 (1) of the Act 30 of 1963 instead of under Section 8 (2) (ii) of the Act 30 of 1963. A reading of Section 8, it would be clear that once the grant is iruwaram minor inam, then Section 8(2) alone will be applicable and in this case, the service-holders, namely, the Archakas are entitled to Ryotwari patta as per Section 8(2)(ii) of the Act 30 of 1963.

8.4. The Judgment of the Tribunal has to be read as a whole and the various findings therein would operate as issue estoppel as between the parties and therefore, subsequently, now the S.R.Lakshmana Bhattar or Alangara Bhattar @ Paramasamy Bhattar or their heirs or alienees cannot claim to a contrary that the inam was a personal inam to them and that the Ryotwari patta has been granted under Section 8 (1) of the Act. Once the inam is not a personal inam and is only a Devadhayam to the office holders being Archakas, in consideration of performing the service, the entitlement is only for posession and enjoyment of the lands so long they perform the service. Section 8 (5) of the Act 30 of 1963, reads as follows:

“(5) In the case of a minor inam held immediately before the appointed day by an individual on condition of rendering service to a religious, educational or charitable institution, the grant of ryotwari patta under subjection (1) or (2) shall be subject to the provisions of Section 21.”

8.5. Section 21 is titled “Service Inams”. S.21(1) makes the provisions applicable in respect of any minor inam which was held immediately before the appointed day by any individual on condition of rendering service to the institution. The instant case admittedly is on condition of rendering of service and as such the Section 21 applies. Section 21(2) mandates that the service holders are bound to continue the service. Section 21(3) grants an option to the service holders to pay the amount as stipulated to the institution and get the land discharged from the obligation or to hold the land and continue the service. Admittedly, in this case, the first option was not exercised by the Archakas. Therefore, they only ‘hold the land and continue the service’. Once they continue, then as per Section 21(7), they shall be entitled to ‘occupy permanently’ the lands and if they fail to continue the service, the prescribed officer shall after such inquiry notify such default and thereafter the institution will be entitled to hold the land as its absolute property.

8.6. As a matter of fact, the S.R.Lakshmana Bhattar himself executed a registered exchange deed dated 16.05.1984, which was extracted above which by itself would show that it was the clear understanding of the said S.R.Lakshmana Bhattar and others that it was only an inam attached to the office. If it is a personal inam, S.R.Lakshmana Bhattar cannot exchange the property with himself and seek for approval.

8.7. It can be seen from the various correspondences that even though there has been recommendations from the fit person of the temple and the Assistant Commissioner, ultimately, the competent authority, viz., the Commissioner never granted approval for the transaction and as such by virtue of Section 30 (1) of the Act, the initial transaction and subsequent transactions are void.

8.8. There can be no two opinion that if it is an inam attached to the office, then there is only a right to enjoyment and there cannot be any right to alienation. In Narayanasamy Dasari’s case (cited supra) the co-ordinate Bench of this Court held as follows:

“In the first explanation, it is made clear that any inam granted to an archaga, service holder or other employee of the religious institution for the performance of any service or charity in or connected with a religious institution shall not be deemed to be a personal gift to the archaga- service holder or employee, but shall be deemed to be a religious endowment.

…………………….

Though it was in the name of the plaintiff’s ancestor, it would squarely fall under the explanation to Section 5 (17) of the Act.”

(emphasis supplied)

Thus, we answer the question that the Archakas/their legal heirs are not entitled to alienate the lands in question and were enjoined only to occupy and hold the property permanently so long as they continue the service.

Question No. II:-

- From the answer above, it would be clear from Section 21 (7) of the Act 30 of 1963 that it is only a right to occupy the lands permanently, which is the subject matter of service inam. The Hon’ble Supreme Court of India in Sankaranarayana swamy Devasthanam’s case (cited supra), in paragraph No.17 held as follows:-

“Once it is clear that even as per the admitted case of the respondent, it was a grant burdened with the service and that there was a right of resumption under Section 21 (7) of the Act, the respondent cannot resist the relief sought by the temple. In other words, the sale deeds in favour of the respondent or his predecessors in title cannot take away the statutory right of the appellant temple to resume the lands.”

The statutory right to resume is not only granted under Section 21(7) of the Act 30 of 1963, in case of default in service, but is also granted under the HR & CE Act, for various other grounds. Section 41 of the HR & CE Act is extracted hereunder for ready reference:-

“41. Resumption and re-grant of inam granted for performance of any charity or service.-

(1) Any exchange, gift, sale or mortgage and any lease for a term exceeding five years of the whole or any portion of any inam granted for the support or maintenance of a religious institution or for the performance of charity or service connected therewith or of any other religious charity and made, confirmed or recognised by the Government shall be null and void:

Provided that any transaction of the nature aforesaid (not being a gift) may be sanctioned by the Government as being necessary or beneficial to the institution.

Explanation. Nothing contained in this sub-section shall affect or derogate from the rights and obligations of the landholder and tenant in respect of any land which is ryoti land as defined in the [Tamil Nadu] Estates Land Act, 1908 (¹[Tamil Nadu] Act I of 1908).

(2)(a) The Collector may, on his own motion, or on the appli- cation of the trustee of the religious institution or of the Commissioner or of any person having interest in the institution who has obtained the consent of such trustee or the Commissioner, by order, resume the whole or any part of any such inam, on one or more of the following grounds, namely:-

(i) that except in the case referred to in the proviso to sub- section (1), the holder of such inam or part or the trustee of the institution has made an exchange, gift, sale or mortgage of such inam or part or any portion thereof or has granted a lease of the same or any portion thereof for a term exceeding five years, or

(ii) that the religious institution has ceased to exist or the charity or service in question has in any way become impossible of performance, or

(iii) that the holder of such inam or part has failed to perform or make the necessary arrangements for performing, in accordance with the custom or usage of the institution, the charity or service for performing which the inam had been made, confirmed or recognized as aforesaid, or any part of the said charity or service, as the case may be.

When passing an order under this clause, the Collector shall determine whether such inam or the inam comprising such part,as the case may be, is a grant of both the melvaram and the kudivaram or only of the melvaram:

Provided that, in the absence of evidence to the contrary, the Collector shall presume that any minor inam is a grant of both the melvaram and the kudivaram.

(b) Before passing an order under clause (a), the Collector shall give notice to the trustee, to the Commissioner, to the inamdar concerned, to the person in possession of the inam where he is not the inamdar and to the alienee, if any, of the inam; the Collector shall also publish a copy of such notice in such manner as may be prescribed and such publication shall be deemed to be sufficient notice to every other person likely to be affected by such order; and the Collector shall hear the objections, if any, of the persons to whom such notice is given or deemed to be given and hold such inquiry as may be prescribed.

Explanation. Where only a part of the inam is affected, notice shall be given under this clause to the holder of such part as well as to the holder or holders of the other part or parts, to the person in possession of every such part where he is not the holder thereof, and to the alienee, if any, of every such part; and the objections of all such persons shall be heard by the Collector.

(c) A copy of every order passed under clause (a) shall be communicated to each of the persons mentioned in clause (b), and shall also be published in the manner prescribed.

(d) (i) Any party aggrieved by an order of the Collector under clause (a) may appeal to the District Collector within such time as may be prescribed, and on such appeal, the District Collector may, after giving notice to the Commissioner and each of the persons mentioned in clause (b) and after holding such inquiry as may be prescribed, pass an order confirming, modifying or cancelling the order of the Collector.

(ii) The order of the District Collector on such appeal, or the order of the Collector under clause (a) where no appeal is preferred under sub-clause (i) to the District Collector within the time prescribed, shall be final:

Provided that where there has been an appeal under sub clause (i) and it has been decided by the District Collector of where there has been no appeal to the District Collector and the time for preferring an appeal has expired, any party aggrieved by the final order of the District Collection as the case may be, may file a suit in a Civil Court for determining whether the inam comprises both the melvaram and the kudivaram or only the melvaram. Such a suit shall be instituted within six months there has been an appeal under sub-clause (i), or from the date of appeal to the District Collector where there has been no such appeal.

(e) Except as otherwise provided in clause (d), an order of resumption passed under this section shall not be liable to be questioned in any court of Law.

(f) Where any inam or part of any inam is resumed under this section,the collector pr the District collector as the case may be,shall by order, re-grant such inam or part-

(i) as an endowment to the religious institution concerned,

or

(ii) in case of resumption on the ground that the religious institution has ceased to exist or that the charity or service in such part; and question has in any way become impossible of performance, as an endowment for such religious, educational or charitable institution as the Commissioner may recommend.

(g) The order of re-grant made under clause (f) shall, on application made to the Collector within the time prescribed, be executed by him in the manner prescribed.

(h) Nothing in this section shall affect the operation of section 40.”

(emphasis supplied)

9.1. Section 41 read in conjunction with Section 34 of the HR & CE Act, it would be clear that any such alienation is null and void and are not binding on the temple and the temple is entitled for resumption of the land. In the present case, even though permission was sought from the Commissioner, the same was never granted. In respect thereof Section 41 (2) (a) categorically enjoins upon the Collector on his own motion, or on the application of the trustee of the religious institution or the Commissioner or of any person having interest in the institution who has obtained the consent of such trustee or the Commissioner, by order, resume the whole or any part of any such inam, if the holder of the inam has made an exchange, gift, sale or mortgage of such property. Therefore, in the instant case, the Archakas though rendered service, had made exchange and sale of the properties and as such it is the bounden duty of the Collector to resume the lands.

9.2. The further reasoning of the Collector that Section 41 will not apply after grant of Ryotwari patta is fallacious. Firstly, it will render the very Section 41(2) otiose after coming into force of the Act 30 of 1963. Secondly, even after grant of patta, in case of the grant coupled with service to the temple, Section 21 of the Act 30 of 1963 terms the same as ‘Service Inams’. Thirdly, a reading of the entire S.41 of the HR & CE Act, it would be clear that the properties in the hands of the such service holders are resumable even after grant of Ryotwari Patta.

9.3. As a matter of fact, it is held by the Hon’ble Supreme Court of India that this Court not only exercises jurisdiction but also should act as the parens patriae in respect of the property belonging to the deity which is considered to be a perpetual minor. Useful reference in this regard can be made to the Judgment of the Supreme Court of India in Joint Commissioner, HR& CE Department Vs. Jayaraman. In that view of the matter, the directions issued by the Learned Single Judge to resume the lands are in order. Accordingly we answer the question that the District Collector has jurisdiction and is liable to entertain the application of the temple for resumption of land under Section 41 of the HR & CE Act.

The Result :

- In that view of the matter, the findings of the learned Judge that the temple is the holder of the properties in question and that the order of the RDO as well as the Collector are erroneous and that the further direction given to the Collector to resume the land by duly following the procedure as contemplated under Section 41 (2) of the Act is in order.

10.1. Accordingly, finding no merits, the Writ Appeals stand dismissed. No costs. Consequently, C.M.P.Nos.17444, 17446, 20343, 20344, 20602 and 20603 of 2023 stand closed.

(S.V.G., C.J.,) (D.B.C., J.,)

05.03.2024

Index : Yes

Speaking order

Neutral Citation : Yes

Jer

To

- The District Collector,

Madurai District,

Madurai. - The Revenue Divisional Officer,

Madurai. - The Commissioner,

The Hindus Religious and Charitable Endowments

Department (HR and CE),

Nungambakkam High Road,

Chennai – 600 034.

THE HON’BLE CHIEF JUSTICE

AND

D.BHARATHA CHAKRAVARTHY, J.,

Jer

Judgment made in

Writ Appeal Nos.2487, 2054 and 2432 of 2023

05.03.2024

1 2001 SCC On Line Mad 308

2 AIR 1961 SC 1350

3 (1936) 71 Mad LJ 398

4 ILR 45 Mad 620

5 AIR 1966 SC 1457

6 1993 Supp (4) SCC 519

7 (2021) 10 SCC 222

1Useful reference in this regard can be made to the Article Titled “Minor Inam – What it is under Madras Act XXX and XXXI of 1963” by C.V. Sankarananaryanan, Advocate, reported in 1969 Vol 2 MLJ 60