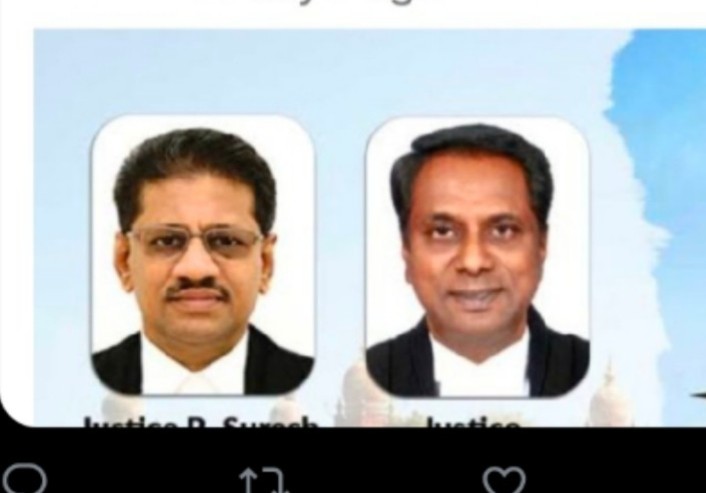

Single judge order upheld /employees case /THE HONOURABLE MR. JUSTICE R.SURESH KUMAR AND THE HONOURABLE MR. JUSTICE K.KUMARESH BABU

THE HONOURABLE MR. JUSTICE R.SURESH KUMAR AND THE HONOURABLE MR. JUSTICE K.KUMARESH BABU

Writ Appeal No.1892 of 2019 and C.M.P.Nos. 12849 of 2019 & 6954 of 2021

Tamil Nadu Tea Corporation Ltd., rep by its Managing Director.

Appellant

Vs

- Tantea Employees’ Federation, Represented by its Working President,

- State of Tamil Nadu, Represented by its Secretary, Finance Department,

- The Secretary, Forest Department, Govt. of Tamil Nadu,

MADRAS

RESERVED ON 27.03.2024

PRONOUNCED ON 30.04.2024

CORAM

THE HONOURABLE MR. JUSTICE R.SURESH KUMAR AND THE HONOURABLE MR. JUSTICE K.KUMARESH BABU

Writ Appeal No.1892 of 2019 and C.M.P.Nos. 12849 of 2019 & 6954 of 2021

Tamil Nadu Tea Corporation Ltd., rep by its Managing Director.

Appellant

Vs

- Tantea Employees’ Federation, Represented by its Working President,

- State of Tamil Nadu, Represented by its Secretary, Finance Department,

- The Secretary, Forest Department, Govt. of Tamil Nadu,

recommendation which has been accepted by the State Government.

- The facts leading to this Intra Court Appeal are that the employees who are represented by the first respondent union claimed the benefits of Government Order in G.O.Ms.No.762, dated 20.08.1986, wherein the Government accepting the recommendations of the One Man Committee, had issued orders revising the pay scales of the Technical Staffs. The said claim had been rejected by the appellant herein on the ground that the qualification of the technical staffs in their service is different than the qualifications prescribed by other Government Departments. The first respondent union being aggrieved against the order of rejection had approached the Government and by order dated 02.03.2006, the third respondent represented by the Deputy Secretary to the Government had refused to interfere with the decision of the Board against which the Union had filed a Writ petition in which the impugned order came to be passed. The learned Single Judge after giving a factual finding that the appellant herein had been implementing the pay commission recommendations which were accepted by the Government has no reason to wriggle out of the recommendations of the Government order based on the One Man Committee’s recommendation and therefore had set aside the order passed by the appellant as well as the third respondent with a further direction to comply with the Government order, dated 20.08.1986 and also to give benefits of subsequent pay commission recommendations. Aggrieved against the same, the present appeal had been filed. It is to be noted that even though the order of the third respondent had been set aside, no appeal had been preferred by the Department.

- Heard Mr.P.Raghunathan, learned counsel for M/s.T.S.Gopalan & Co. for appellants, Mr.V.Ajay Khose, learned counsel appearing for the first respondent, Mr.U.M.Ravichandran, learned Special Government Pleader appearing for the second respondent and Mr.S.Rajesh, learned Government Advocate appearing on behalf of the third respondent.

- The learned counsel for the appellant had broadly formulated his submissions in assailing the order passed by the learned Single Judge which are as follows:

(a) Whether the workers have a legal right to seek

implementation of the One Man Committee’s recommendations as accepted by the Government?

(b) Even if such a legal right subsist in them, whether their claim would be hit by delay and latches?

(c) When they have an alternative remedy of approaching the Industrial Tribunal, whether the Writ Petition under Article 226 of the Constitution of India would be maintainable ?

(d) Even if it is assumed that the relief under Article 226 of the Constitution of India can be given, whether such relief could be entertained to revive a stale claim? - The learned counsel for the appellant would submit that the appellant is not duty bound by the decision of the Government in implementing the recommendations of the pay commission. He would submit that the appellant is an independent legal entity. Even though the shares of the company is wholly held by the Government, no financial assistance are being extended by the Government nor any subsidy is being paid to the company. From the inception, the company has been running under loss and to even meet the payment of salary, the Government does not provide any assistance and the appellant company avails the benefit of loan to fulfill its financial commitments. In that scenario, he would submit that there is no legal right on the part of the first respondent Union/ the workers to seek implementation of the recommendations of the pay commission. It solely vest with the wisdom of the Board of Directors of the appellant company to decide and to adopt the Government orders by implementing the recommendations of the pay commission. A conscious decision has been taken by the Board of Directors not to implement the Government order in GO.MS. No. 762, Finance Department dated 20.08. 1986, for the reason that the appellant Corporation is already reeling under heavy loss. He would submit that the learned Single Judge under the impugned order had given a factual finding that the appellant Corporation had been adopting the Government’s decision on pay commission’s recommendation and the same has been implemented by the appellant on which basis alone he had passed the impugned order. In that context, he would submit the learned Single Judge wholly erred in failing to consider the nature of the appellant

Corporation being a separate legal entity and it is only bound by its own Rules and Regulations and the wisdom of the Board of Directors in implementing the decision of the Government. He would further submit that the Government order which is sought to be implemented had categorised technical staffs into two categories namely those who had passed SSLC with ITI certificate and those who have failed in SSLC with ITI certificate. The technical staffs who have been appointed with the appellant Corporation were only required to pass only 8th standard with ITI certificate. There was no necessity for a person to hold SSLC certificate for getting an appointment with the appellant Corporation. Therefore, he would submit that the criteria upon which a technical staff is appointed in the appellant Corporation and the qualification of a technical staff in other Departments is totally different and this could be an intelligible differentia in refusing to extend such benefit that had been given under the G.O to the technical staffs of the appellant Corporation. This aspect according to him had been clearly overlooked by the learned Single Judge. He would further submit that when the respondent Union/Workers has a remedy of alternative for approaching the Industrial Tribunal, the Writ Petition ought not to have been entertained. According to him the learned Single Judge had not considered this issue of maintainability of the Writ Petition even though it has been specifically raised by the appellant Corporation itself would render the order impugned which is liable to be interfered with by this Court. He would further submit that the Government order which is sought to be implemented in respect of the workers belonging to the first respondent

Union was made in the year 1986. However, had sought the benefit of such Government order only in the year 1996 that too after 5th pay commission recommendations as accepted by the Government was also implemented by the appellant Corporation in respect of technical staffs working with it. Therefore, he would submit that such a direction to revive a stale claim that is a claim that had been made after 10 years ought not to have been entertained by the learned Single Judge. Further, he would submit that when even if such a delayed claim is to be allowed, the same should be restricted to 3 years prior to filing of Writ Petition. - In support of his contention, the learned counsel for the appellant had relied upon judgments of the Hon’ble Apex Court in the case of

C.Jacob Vs Director of Geology and Mining and another reported in 2008

(10) SCC 115 and in the case of Union of India and Others Vs M.K.Sarkar reported in 2010 (2) SCC 59 to contend that the delay or latches should not revive a stale claim. He has also relied upon the judgment of the Hon’ble Apex Court in the case of A.K.Bindal and another Vs Union of India and

Other reported in 2003 (5) SCC 163 to contend that an employee of a

Corporation, even though where the shares have been wholly held by the Government cannot be compared to be a Government servant to claim wages that is paid to a similarly placed person under the Government service. He had also placed reliance upon the judgment of the Hon’ble Apex Court in the case of Union of India and Others Vs Tarsem Singh reported in 2008 (8) SCC 648 to contend that even if they are entitled for the benefit under the G.O.Ms.No.762 dated 20.08.1986, relief should have been

restricted prior to 3 years of filling of this Writ Petition. - Countering his arguments, MrV.Ajay Khose, learned counsel for the first respondent would submit that the members of the first respondent Union have been independently making claims from the year 1989 immediately after the issuance of the Government Order in G.O.Ms.No.762, for grant of benefits under the G.O. However, the appellant had been giving one reason or the other in refusing to extend the benefits. Finally, having no other remedy, they had approached this Court originally by way of a Writ Petition in W.P.No.1067 of 1996, seeking for a Mandamus in which orders were in the year 2002. Only, thereafter, the appellant had rejected the claim of the Union on the basis of the qualifications that were prevalent in the appellant Corporation, by distinguishing the workers of the first respondent

Union to be not equal to the technical staff working in the other Departments. He would submit that no other reasons had been enumerated in the order impugned in the Writ Petition and now by way of additional reasons, the appellant cannot be allowed to substantiate the order passed by them. In that reference, the learned counsel would rely upon the judgment of the Hon’ble Apex Court in Mohinder Singh Gill’s case reported in 1975 SCC 1 405. - He would further contend that the appellant Corporation had been implementing the various decisions of the Government in accepting the recommendations of the pay commissions hitherto. They had not implemented the Government order of the year 2006, in which the Government accepting the recommendations of the One Man Committee had revised the pay scales of the technical staffs. He would further submit that in view of the non implementation of the same, the workers of the first respondent Union did not get full benefits of the subsequent pay commissions, which anomaly even exists today. Therefore, he would submit that the claim of the appellant that there was a delay is without any merits as the claim of the workers of the first respondent Union even as on today is existing. He would further submit that the workers are willing to receive 50% of the monetary benefits, as that would have been available to them by considering that their employer is under a financial crisis, though cannot be a reason that can be assigned by the employer to deny pay and allowances.

- We have considered the rival submissions made by the learned counsels appearing in either side and perused the materials available on record before this Court. We are obligated to consider all the issues raised by the appellant and the following questions arise for our considerations.

- As to whether the claim of the first respondent Union is hit by delay and latches?

- When an alternative remedy was available, whether the

Court would grant relief under Article 226 of the Constitution of India? - Whether there was a legal right on the union/ workers to seek implementation of the One Man Committee?

- If such a legal right is available, whether such a right could be sought to be remedies belatedly?

Question No.1 - The bone contention of the learned counsel for the appellant is that the first respondent union had belatedly approached this Court. In that context, he would submit that when the Government order which is sought to be implemented was made in the year 1986. The first respondent Union had only approached this Court in 1996 that too after the 5th pay commission had been rolled out. The first respondent, by its affidavit filed in support of the Writ Petition had specifically pleaded that in view of the non implementation of the Government order in the year 1986, the benefits that were to be accrued to them under the 5th pay commission which was introduced in the year 1989, as implemented by the appellant Corporation did not enure to them and therefore, they had been making representations and since the same had not been considered, they had approached this Court earlier by filing a Writ Petition in W.P.No.1067 of 1996. This allegation/ averment made by the first respondent had not been answered by the appellant specifically in the counter affidavit filed by it. Further, when the appellant had taken a conscious decision to implement the recommendations of the pay commission as adopted by the Government, it was also duty bound to follow the Government orders which had set at naught the anomalies that would arise in implementing the recommendations of the respective pay commissions as has being rectified by the Government subsequently. Further, the cause of action is a continuing cause of action as a wrong fixation of pay at a relevant point of time would have a cascading effect on an employee till his date of retirement. Further, the appellant had already not raised the issue of delay or latches, before the learned Single Judge and has not rejected the claim of the first respondent Union on the ground of delay and latches. In such a view of the matter, we are of the view that the claim of the first respondent Union/ workers would not be hit by delay and latches.

Question No 2 - The availability of an alternative remedy would ordinarily be a bar for the aggrieved person to approach this Court under Article 226 of the Constitution of India, when a disputed question of facts are raised in a Writ Petition, normally a Writ Court would keep at the hands of directing the parties to approach the appropriate authority with whom an alternative remedy would be available. In the present case, we do not find any disputed question of facts raised which arise for consideration. The reason attributed by the appellant is that the qualifications prescribed for appointment in the appellant Corporation for the technical staff was VIII standard pass + ITI. However, the Government order had only envisaged the pay scales for an employee with SSLC pass/ fail + ITI. Since, the qualifications prescribed by the appellant Corporation was lesser than the qualifications that had been prescribed by the Government, the same could not be implemented. In our considered view, what falls for interpretation is as to whether such a contention could be countenanced by the appellant. There are no disputed question of facts that arises for us to lay off our hands. Further, the claim of the first respondent Union relates back to the year 1986 and even though the earlier Writ Petition was only disposed of by this Court in the year 2002 and the appellant had also passed the order in the year 2002, the third respondent had taken more than 4 years to pass such an order. Since, we had already given a finding that there are no disputed question of facts and that the issue can be resolved based on the pleadings made by the respective parties, we do not wish to entertain the argument of availability of alternative remedy.

Question No.3 & 4 - The learned counsel for the appellant had vehemently contended that the workers of the appellant Corporation do not have a legal remedy to seek implementation of the Government order that had been made based upon the One Man Committee. It is an admitted case that the appellant had adopted and implemented the Government order in G.O.Ms.No.555, Finance Department dated 10.06.1985, wherein, the recommendations of the

4th Pay Commission have been accepted and implemented by the Government. Since, various anomalies had arose in respect of pay of the technical staffs in various Government Departments, an One Man

Committee had been appointed by the Government. The said One Man Committee, after detailed examination of various factors had recommended a uniform pay scale for the technical staffs in various Government Department by categorising them into 2 categories, such as SSLC pass + ITI certificate and SSLC fail + ITI certificate. The reason for adopting the basic qualification of SSLC had been spelt out explicitly in the Government order of the year 1986. The One Man Committee had considered the minimum qualification that was prevalent at that relevant point of time for admission to ITI courses for various trades. We take judicial notice of the fact that during the relevant point of time, the basic qualification for joining ITI courses in various trades was a pass in intermediate (VIII standard). It is also further to be noted that during the 5th Pay Commission

recommendations were made only to take the qualification of ITI in respect of technical staff taking note of the above anomaly, as certain of the candidates who had earlier passed ITI, had the required qualification at that relevant point of time namely VIII standard and when the basic qualification for admission to ITI had been increased, the candidates who had obtained

ITI certificate had SSLC. The said recommendations of the 5th Pay

Commission had also been accepted by the Government in G.O.Ms.No.511, Finance Department, dated 01.08.1992 and has also been adopted by the appellant Corporation and the benefits of the 5th Pay Commission have also been extended. But, however in respect of the pay scale that they have been receiving on the 4th Pay Commission recommendation but not on the modified pay scale, pursuant to the Government Order of the year 1986. - It is to be noted that when the Pay Commission’s

recommendations are accepted by the Government and when the employees point out certain anomalies in the said recommendations when being implemented by the Government in respect of disparity in pay, then the Government appoints an One Man Committee to look into such pay disparity of the employees of the particular cadre working in various Government Departments/ institutions. If the One Man Committee points out the anomalies and suggest modification to dispel the anomaly, the Government may consider accepting the One Man Committee’s recommendation. When the Government accepts the recommendations of the One Man Committee and makes an order accepting the One Man Committee’s Report dispelling the anomaly, then such dispelling amounts to modification of the original Government order accepting the recommendations of the Pay Commission.

Viewing the case from that angle on the admitted fact that the appellant Corporation had adopted and implemented the Government order of the year 1986 of the Government, in accepting the recommendations of the 5th Pay Commission. They cannot claim not to further adopt and implement the further Government order which rectifying the anomalies had modified pay scale was fixed. Since, such Government order rectifying the anomaly would date back to the date of the first Government order accepting the Pay Commission’s recommendations, the claim of the appellant that the respondent do not have any legal right in seeking the implementation of the Government Order based on One Man Committee recommendations would have to fall. - In view of our answer to question no.3, question no.4 is of no consequence.

In view of the aforesaid reasoning and findings, we find no reasons to interfere with the order impugned before us, since, the order passed by the learned Single Judge had granted only three months time for them to implement the order passed in the Writ Petition, we now grant three months time to the appellant Corporation from the date of receipt of a copy of this order to implement the directions given by the learned Single Judge. - In fine, this Writ Appeal is dismissed. However, there shall be no order as to costs. Consequently, connected miscellaneous petition are

R.SURESH KUMAR., J. and K.KUMARESH BABU.,J.

Gba

A Pre-delivery order made in

Writ Appeal No.1892 of 2019 and C.M.P.Nos.12849 of 2019 & 6954 of 2021

30.04.2024