full order of IN THE HIGH COURT OF JUDICATURE AT MADRAS DATED: 26.06.2023 CORAM : THE HONOURABLE DR.JUSTICE ANITA SUMANTH W.P.Nos. 14536, 14538, 14539, 14542 14544, 14599, 14604, 14616, 14613, 14620, 14611,Mr.S.Prabhu M.Murali, GA for R1 Mr.R.Gopinath for R2 Dr.B.Ramaswamy, SSC for R3 COMMON ORDER All the petitioners in these batch are primary agricultural credit cooperative society. 2. The challenge in all these petitions is to circular dated.Dr. B. Ramaswamy, Senior Standing Counsel for the Income Tax Department represented the Income Tax Officer for the multiple districts of Tamil Nadu. The 81 Writ Petitions are dismissed both on the grounds of maintainability as merits

IN THE HIGH COURT OF JUDICATURE AT MADRAS DATED: 26.06.2023

CORAM :

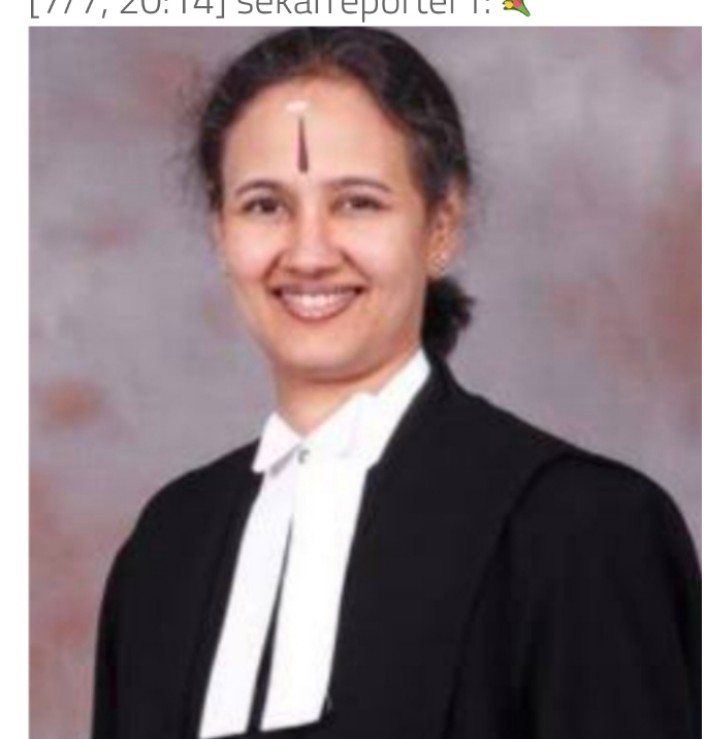

THE HONOURABLE DR.JUSTICE ANITA SUMANTH

W.P.Nos. 14536, 14538, 14539, 14542 14544, 14599, 14604,

14616, 14613, 14620, 14611, 14621, 14617, 14624, 14626,

15430, 15579, 15581, 15585, 15587, 15434,15435, – 15471,

15475, 15479, 15482, 15484, 15472, 15481, 15478, 15486,

15489, 15476, 15483,15488, 15492, 15495, 15526, 15531, 15532,

15537, 15539, 15534, 15538, 15540, 15541, 15544, 15551, –

15606, 15608, 15634, 15646, 15648, 15635, 15641, 15645,

15649, 15652, 15640, 15650, 15656, 15659, 15660, 15653,

15657, 15661, 15664, 15667, 15658, 15662, 15666, 15669,

15672, 15678, 15680, 15682, 15684, 15687, 15690, 16295, 21300, 21305, 21307 of 2022 and

W.M.P.Nos. 13728, 13731, 13734, 13735, 13736, 13737, 13739,

1374013744, 13745, 13795, 13796, 13802, 13804, 13818, 13821,

13814, 13816, 13824,13825, 13813, 13815, 13826, 13827, 13820, 13822, 13831, 13833, 13837, 13838, 14578, 14579, 14756,

14757, 14763, 14764, 14770, 14772, 14777, 14779,14582, 14583,

14584, 14586,14626, 14627, 14631, 14632, 14636, 14638, 14640,

14642, 14659, 14660,14628, 14629, 14641, 14643, 14634, 14635,

14647, 14648, 14650, 14652, 14637, 14633, 14644, 14645,

14649, 14651, 14653, 14654, 14657, 14658, 14697, 14698,

14700, 14702, 14707, 14708, 14715,14716, 14719, 14720, 14709,

14711, 14717, 14718, 14721, 14722, 14723, 14724, 14729,

14730, 14733, 14734, 14818, 14819, 14822, 14823, 14856,

14857, 14868, 14869, 14873, 14875, 14858, 14860, 14863,

14865, 14870, 14871, 14874, 14876, 14880, 14881, 14864,

14866, 14877, 14879,14885, 14886,14891, 14892, 14893, 14896,

14882, 14883, 14887, 14889, 14894, 14897, 14900,14902, 14905,

14906, 14888, 14890, 14895, 14898, 14901, 14904, 14908,

14910, 14913, 14914, 14918, 14920, 14922, 14925, 14927,

14928, 14932, 14933, 14934, 14935, 14936, 14937, 15623,

15624, 20308, 20309, 20311, 20312, 20314, 20315 of 2022

W.P.No.14536 of 2022

S.161 Podaturpet Venkateswara Primary

Agricultural Co-operative Credit Society Ltd.,

Rep. by its Secretary V.N.Dhamodharan,

Podaturpet Post,

Pallipet Taluk,

Tiruvallur District – 631 208. .. Petitioner

vs

1.The Income Tax Officer, Office of the Income Tax Officer, Thiruvallur District, Thiruvallur.

2.Kancheepuram Central Co-operative Bank Ltd,

Rep. by its Additional Registrar/ Managing Director,

No.15-G Sekkupettai North Street,

Ennaikkaran,

Kancheepuram – 631 501, Kancheepuram District. .. Respondents

Prayer in W.P.No.14536 of 2022 : Petition filed under Article 226 of the Constitution of India praying to issue a writ of certiorari calling for the entire records relating to order of 2nd respondent in its proceedings in Na.Ka.1545/2006-07/P.13 dated 29.03.2021 and quash the same.

W.P.Nos. For Petitioner For Respondents

14536, 14538, 14539,

14542 14544, 14599,

14604, 14616, 14613,

14620, 14611, 14621,

14617, 14624, 14626,

15430, 15579, 15581,

15585, 15587,

15434,15435, 15606,

15608, 15634, 15646,

15648, 15635, 15641,

15645, 15649, 15652,

15640, 15650, 15656,

15659, 15660, 15653,

15657, 15661, 15664,

15667, 15658, 15662,

15666, 15669, 15672, Mr.K.Selvaraj Dr.B.Ramaswamy, Senior Standing Counsel for R1

Mr.R.Gopinath for R2

W.P.Nos. For Petitioner For Respondents

15678, 15680, 15682,

15684, 15687, 15690,

16295, 21300, 21305,

21307

15471, 15475, 15479,

15482, 15484, 15472,

15481, 15478, 15486,

15489, 15476, 15483,

15488, 15492, 15495,

15526, 15531, 15532,

15537, 15539, 15534,

15538, 15540, 15541,

15544, 15551 Mr.S.Prabhu M.Murali, GA for R1

Mr.R.Gopinath for R2

Dr.B.Ramaswamy,

SSC for R3

COMMON ORDER

All the petitioners in these batch are primary agricultural

credit cooperative society.

2. The challenge in all these petitions is to circular dated

29.03.2021 issued by the District Central Cooperative Banks in Tiruvallur, Kancheepuram, Chennai, Salem, Coimbatore and Trichy, arrayed as R2 in all the writ petitions and (hereinafter referred to as ‘Banks’).

3. I have had an occasion to consider an identical issue as arising in these writ petitions in a batch of writ petitions filed by identically placed primary agricultural cooperative credit societies

and have passed an order on 04.11.2022 to following effect:-

“This batch of Writ Petitions has been filed by

Primary Agricultural Co-operative Credit Societies (in short ‘Society/Societies’) and turns on the appreciation of a common set of facts as well as legal provisions.

2. All the petitioner societies challenge Circulars issued by the District Central Cooperative Banks, Salem, Kancheepuram and Kumbakonam, arrayed as R2 in all writ petitions (referred to as ‘Banks’) bearing Na.Ka.No.2416/95/Accts. dated 16.03.2021, Na.Ka.1545/2006-07/P.13 dated

29.03.2021 and Na.Ka.No.2727/2020-B3, dated 07.01.2022 respectively. The societies function for the purposes of advancing crop and fertilizer loans to agriculturalists and have accounts with R2 banks.

3. The impugned Circulars refer to the statutory mandate of Section 194 N of the Income Tax Act, 1961 (in short ‘Act’) providing for deduction of tax on cash withdrawal. The provisions of Section 194 N coming under Chapter XVII dealing with ‘collection and recovery – deduction at source’ provides for deduction of an amount equal to 2% of any cash withdrawal made by persons from (i) a banking company to which the Banking Regulation Act, 1949 (10 of 1949) applies (including any bank or banking institution referred to in section 51 of that Act);

(ii) a co-operative society engaged in carrying on the business of banking; or

(iii) a post office.

4. It is the case of the petitioners that there should be no deduction at all, that could be effected from the withdrawals made by them from the banks. The petitioner societies are intermediaries between the bank and agriculturists, who are beneficiaries of the withdrawals made by the petitioners.

5. In most instances, the amounts have been sanctioned by the State and the petitioner societies are mere conduits or facilitators. Thus, deduction of tax, in such a situation, would greatly prejudice the ultimate beneficiaries of the loans who are farmers and small traders.

6. That apart, the funds withdrawn by the petitioners for onward transmission to the farmers, even if construed to be the income of the petitioner societies together with other incomes earned by the societies, are entitled for deduction in terms of Section 80P of the Act. This would also support their stand that no tax is liable to be deducted at source from the withdrawals.

7. The petitioners additionally submit that, in the budget speech of the Hon’ble Finance Minister, while introducing Section 194N, the proposal for deduction of tax of cash withdrawals was restricted to business payments only. The avowed object was ‘to discourage the practice of making business payments in cash’ and it was proposed ‘to levy TDS of 2% of cash withdrawal exceeding one crore in an year from a bank account’. Thus, Section 194N must be held to be applicable only in respect of business payments and the present payments would not come within the ambit of Section 194N.

8. They also refer in their pleadings, to the judgment of the Hon’ble Supreme Court in the case of Commissioner of Income Tax, New Delhi Vs. Eli Lilly and Co. (India) (P) Ltd., [178 Taxmann 505]. This judgment is to the effect that the purpose of provisions for tax deduction under Chapter XVIIB, is to see that any sum which is chargeable to tax under Section 4 of the Income Tax Act must be brought within the ambit of tax with the requisite deduction.

9. Thus, it is only in respect of amounts that constitute income in the hands of the payee that tax should be deducted. In the present case, the withdrawals do not constitute income of the petitioner and hence such liability would not arise.

10. They place great reliance upon a CBDT Notification bearing No.70 of 2019 dated 20.09.2019, whereunder commission agents or traders operating under the provisions of the Agricultural Produce Market Committee (APMC) have been permitted to withdraw cash in excess of one crore without deduction of tax at source, upon them establishing that such withdrawals were for the purpose of making payments to the farmers for purchase of agricultural produce as well as satisfaction of other allied conditions. They would claim parity with the APMCs and thus argue that there would be no liability to tax and consequently no necessity to deduct tax at source.

11. The respondents contest the writ petitions vehemently. The Income tax department reiterates the mandatory nature of Section 194 N. Only the Kanchipuram Central Cooperative Bank Ltd has filed a counter in W.P.No.21856 of 2022 challenging the maintainability of the Writ Petitions in light of the decision of this Court in K.Marappan

V. Deputy Registrar of Co-operative Society (2006

(4) MLJ 641).

12. The Full Bench of this Court has in the above decision, held that under the scheme of the Tamil Nadu Cooperative Societies Act, 1983, it is only the alternative and statutory appeal mechanism, particularly appeal provision under Section 153 that must be invoked by the Cooperative Societies. The Banks also point out that the Circulars merely draw attention to the statutory provisions of the Income tax Act in regard to tax deduction.

13. Heard learned counsel. The counter filed by the Kancheepuram Central Cooperative Bank Limited, R2 in W.P.No.21856 of 2022 states that there are 264 Primary Agricultural Societies (PACCS) functioning under it. Pursuant to the introduction of Section 194 N w.e.f. 01.07.2020, there was a wide ranging survey by the Income-tax Department where it was noticed that the bank had not deducted taxes for the cash payments exceeding, in aggregate, a sum of rupees one crore.

14. The bank was thus taken to task and its liability for non-deduction was determined at a sum of Rs.9,58,77,590/-. This demand relates to the period 01.09.2019 to 31.03.2020, post introduction of Section 194 N as well as the period 2020-21. It is only thereafter, that the banks proceeded to apply the provisions of Section 194 N to insulate themselves from any liability in this regard. The impugned circulars have been issued, and must be seen, in the background of the aforesaid events.

15. The provisions of Section 194 N provide for a mandatory deduction of 2% of cash

withdrawals and the object is to discourage, and drive the move toward a cashless or cash-free economy. The scheme of tax deduction also allows, by way of an application under Section 197, for a payee to seek the remedy of deduction at nil/lower rate under various provisions of the Act. However, Section 194N is conspicuous by its absence therein, and does not figure in the list of such provisions.

16. The intention is clear, that compliance with the requirement of Section 194 N is nonnegotiable except in line with the specific exceptions stipulated under the proviso extracted below:

Provided also that nothing contained in this section shall apply to any payment made to—

(i) the Government;

(ii) any banking company or co-operative society engaged in carrying on the business of banking or a post office;

(iii) any business correspondent of a banking company or co-operative society engaged in carrying on the business of banking, in accordance with the guidelines issued in this regard by the Reserve Bank of India under the Reserve Bank of India Act, 1934 (2 of 1934);

(iv) any white label automated teller machine operator of a banking company or co-operative society engaged in carrying on the business of banking, in accordance with the authorisation issued by the Reserve Bank of India under the Payment and Settlement Systems Act, 2007 (51of 2007):

Provided also that the Central Government may specify in consultation with the Reserve Bank of India, by notification in the Official Gazette, the recipient in whose case the provision of this section shall not apply or apply at reduced rate, if such recipient satisfies the conditions specified in such notification.

17. There is thus, an avenue provided for arecipient falling outside the scope of the exceptions, to seek exemption from the application of Section 194N and hence, if at all the petitioners believe that they qualify for the exemption, they may seek redressal under the in-built statutory mechanism provided as above, if they so choose.

18. To a query from the Court, as to who would constitute the specific authority before whom such prayer was to be made, the respondents have reported written instructions from the Commissioner of Income Tax (TDS), Coimbatore stating thus: ‘As per business allocation rule, Central Government for tax purposes is Finance Minister of India. Hence, any request may be in the name of the Finance Minister with copy to CIT ITA CBDT North Block who would process such requests.’ The petitioners may thus approach the competent authority in the Government seeking relief from the application of Section 194N of the Act.

19. The submissions in relation to the grant of deduction under Section 80P are premature as is reliance upon the judgement in the matter of Eli Lilly. Eligibility to deduction must be tested by the authorities in the course of assessment as it involves the determination of several questions of fact. The society is always entitled to, in the return of income filed by it, seek credit of the taxes attributable to the income returned by it and any excess deduction, if the stand of the societies is accepted in assessment, would have to be refunded to them.

20. My attention is also drawn to an order passed by learned Judge in Madurai in Tirunelveli District Central Cooperative Bank Limited V. The

Joint Commissioner of Income Tax (TDS) (W.P.(MD)Nos.6102 to 6125 of 2020 etc. batch, order dated 27.07.2020).

21. Those Writ Petitions have been allowed and the impugned assessments remitted to the file of the assessing officers to be redone afresh. Inter alia, a direction has been given to the assessing officers to exclude the Pongal cash gift distributed by the petitioner banks at the instance of the Government of Tamil Nadu on the reasoning that the societies had merely acted as business correspondents of the banks.

22. The learned Judge also proceeds to state that it was open to the banks to establish before the assessing officers that the sums withdrawn by the member societies did not represent income in their hands, after considering the evidence available in that regard. In my considered view, the aforesaid examination can be carried out only in the instance of the societies and not at the instance of the banks, who are payers, with statutory responsibility to deduct. That apart, the matter is stated to be pending in appeal in W.A.(MD)Nos.1137 of 2020 etc. batch and interim stay granted on 17.12.2020.

23. For the above reasons, the challenge to the impugned Circulars cannot be entertained as the District Central Cooperative Banks have, therein, merely sought to bring to the notice of the petitioner societies the statutory provisions in regard to deduction of tax, enjoining that they adhere to, and comply with the same, scrupulously. There could be no fault attributed to R2 Banks in this regard.

24. In light of the discussion as above, the challenge to the Circulars fail and these Writ Petitions are dismissed both on the ground of maintainability as well as merits. No costs. Connected Miscellaneous Petitions are also dismissed.”

4. The above order is stated to have attained finality as on

date.

5. Mr.Kalaiselvan, learned counsel, appearing for the

petitioners draws attention to proceedings in

R.C.No.14172/2020/CBP1 dated 19.07.2022 whereunder the

Registrar of Cooperative Societies, has corresponded with the

Principal Secretary to Government, Cooperation, Food and

Consumer Protection Department requesting that the Cooperation, Food and Consumer Protection Department agitate the issue of grant of exemption under the provisions of Section 194 N of the Income-Tax, 1961 to the primary agricultural cooperative credit

societies before the Central Board of Direct Taxes.

6. Pursuant thereto, the Chief Secretary, appears to have

addressed the Chairperson of CBDT on 27.09.2022. This communication is placed at page 20 of compilation dated 05.06.2023. However, there is nothing to indicate whether this representation has indeed been sent and whether it is pending

before the CBDT.

7. In fact in my order dated 04.11.2022, I have recorded

the rival submissions in the context of the appropriate authority to

consider request for exemption and stated thus:-

“18. To a query from the Court, as to who would constitute the specific authority before whom such prayer was to be made, the respondents have reported written instructions from the Commissioner of Income Tax (TDS), Coimbatore stating thus: ‘As per business allocation rule, Central Government for tax purposes is Finance Minister of India. Hence, any request may be in the name of the Finance Minister with copy to CIT ITA CBDT North Block who would process such requests.’ The petitioners may thus approach the competent authority in the Government seeking relief from the application of Section 194N of the Act.”

8. In light of the aforesaid, let notice be issued by the appropriate authority in the CBDT to the petitioner, if at all representation dated 27.09.2022 had been received by CBDT, and request for exemption on behalf of the petitioner societies be considered. If the CBDT is of the view that the representation would

have to be made before any other appropriate authority, the petitioners may be duly informed in order that they can take

necessary steps in this regard.

9. Learned counsel for the petitioner relies on a judgment of the Hon’ble Supreme Court in the case of The Principal Commissioner of Income Tax 17, Mumbai v M/s Annasaheb Patil Mathadi Kamgar Sahakari Pathpedi Limited [C.A.No.8719 of 2022 dated 20.04.2023] deciding the question of whether that petitioner was a cooperative society and not a bank for the purpose of Section 80 P(4) of the Act, in favour of the society and adverse to the Department. The petitioner is at liberty to cite this judgment and any other decisions that it places reliance upon, before the authority hearing the request for exemption.

10. In light of order dated 04.11.2022, these writ petitions are dismissed both on the ground of maintainability as merits with the directions as above. No costs. Connected miscellaneous

petitions are closed.

26.06.2023

Index:Yes

Neutral Citation:Yes ssm

To:

1.The Income Tax Officer, Office of the Income Tax Officer, Thiruvallur District, Thiruvallur.

2.The Additional Registrar/ Managing Director,

Kancheepuram Central Co-operative Bank Ltd,

No.15-G Sekkupettai North Street,

Ennaikkaran,

Kancheepuram – 631 501, Kancheepuram District.

DR. ANITA SUMANTH,J. ssm

W.P.No.14536 of 2022 etc

26.06.2023

[7/7, 20:16] sekarreporter1: [7/7, 20:14] sekarreporter1: The Hon.ble Dr. Justice. Anita Sumanth delivered judgement on the issues related to Agricultural Co-operative Credit Society and The Central Co-operative Bank Limited. All over Tamil Nadu they challenged the circular dated 29.03.2021 issued by the District Central Co-operative Banks. Dr. B. Ramaswamy, Senior Standing Counsel for the Income Tax Department represented the Income Tax Officer for the multiple districts of Tamil Nadu. The 81 Writ Petitions are dismissed both on the grounds of maintainability as merits. [7/7, 20:14] sekarreporter1: 💐 https://sekarreporter.com/7-7-2014-sekarreporter1-the-hon-ble-dr-justice-anita-sumanth-delivered-judgement-on-the-issues-related-to-agricultural-co-operative-credit-society-and-the-central-co-operative-bank-limited-all/

[7/7, 20:17] sekarreporter1: https://twitter.com/sekarreporter1/status/1677328304200712192?t=m8mcG7toZfcTn5P1tS4w8w&s=08

[7/7, 20:17] sekarreporter1: [7/7, 20:14] sekarreporter1: The Hon.ble Dr. Justice. Anita Sumanth delivered judgement on the issues related to Agricultural Co-operative Credit Society and The Central Co-operative Bank Limited. All over Tamil Nadu they challenged the circular dated 29.03.2021 issued by the District Central Co-operative Banks. Dr. B. Ramaswamy, Senior Standing Counsel for the Income Tax Department represented the Income Tax Officer for the multiple districts of Tamil Nadu. The 81 Writ Petitions are dismissed both on the grounds of maintainability as merits. [7/7, 20:14] sekarreporter1: 💐 https://sekarreporter.com/7-7-2014-sekarreporter1-the-hon-ble-dr-justice-anita-sumanth-delivered-judgement-on-the-issues-related-to-agricultural-co-operative-credit-society-and-the-central-co-operative-bank-limited-all/

[7/7, 20:17] sekarreporter1: [7/7, 20:17] sekarreporter1: https://twitter.com/sekarreporter1/status/1677328304200712192?t=m8mcG7toZfcTn5P1tS4w8w&s=08

[7/7, 20:17] sekarreporter1: [7/7, 20:14] sekarreporter1: The Hon.ble Dr. Justice. Anita Sumanth delivered judgement on the issues related to Agricultural Co-operative Credit Society and The Central Co-operative Bank Limited. All over Tamil Nadu they challenged the circular dated 29.03.2021 issued by the District Central Co-operative Banks. Dr. B. Ramaswamy, Senior Standing Counsel for the Income Tax Department represented the Income Tax Officer for the multiple districts of Tamil Nadu. The 81 Writ Petitions are dismissed both on the grounds of maintainability as merits. [7/7, 20:14] sekarreporter1: 💐 https://sekarreporter.com/7-7-2014-sekarreporter1-the-hon-ble-dr-justice-anita-sumanth-delivered-judgement-on-the-issues-related-to-agricultural-co-operative-credit-society-and-the-central-co-operative-bank-limited-all/

[7/7, 20:25] sekarreporter1: District Central Co-operative Banks. Dr. B. Ramaswamy, Senior Standing Counsel for the Income Tax Department represented the Income Tax Officer for the multiple districts of Tamil Nadu. The 81 Writ Petitions are dismissed both on the grounds of maintainability as merits

[7/7, 20:25] sekarreporter1: [7/7, 20:25] sekarreporter1: https://twitter.com/sekarreporter1/status/1677330302648086528?t=dewK1OmKPckcOyF3n1mBGg&s=08

[7/7, 20:25] sekarreporter1: District Central Co-operative Banks. Dr. B. Ramaswamy, Senior Standing Counsel for the Income Tax Department represented the Income Tax Officer for the multiple districts of Tamil Nadu. The 81 Writ Petitions are dismissed both on the grounds of maintainability as merits