Judge senthilkumar ramoorthy order quashed //For Petitioner : Ms.Sri Harini S.P.For R1 : Mr.V.Prashanth Kiran, Govt. Adv. (T)C O M M O N O R D E R

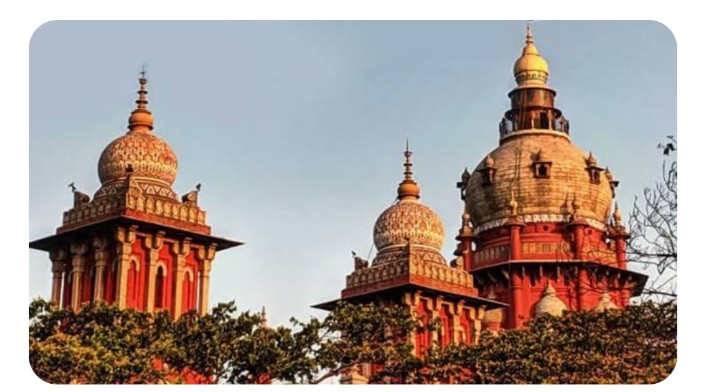

IN THE HIGH COURT OF JUDICATURE AT MADRAS

DATED: 14.03.2024

CORAM:

THE HONOURABLE MR. JUSTICE SENTHILKUMAR RAMAMOORTHY

W.P.Nos.6772 & 6776 of 2024 and W.M.P.Nos.7543, 7545, 7548 & 7551 of 2024

In both WPs.

Vijaykumar,

Sole Proprietor of Tvl.Vijay Enterprises,

10D, Anthonipuram,

Suramangalam, Salem-636 005. …Petitioner

Vs.

1.The State Tax Officer, Suramangalam Assessment Circle, Salem.

2.The Branch Manager,

Canara Bank,

Suramangalam Branch,

Salem-636 005. … Respondents

Prayer in W.P.No.6772 of 2024: Writ Petition filed under Article 226 of the Constitution of India to issue a Writ of Certiorari calling for the records leading to the issuance of assessment order bearing reference 33ACIPV9406H1ZB/2018-2019 dated 24.07.2023 to the extent of demand made against alleged input tax credit mismatch by the 1st respondent and quash the same.

Prayer in W.P.No.6776 of 2024: Writ Petition filed under Article 226 of the Constitution of India to issue a Writ of Certiorari calling for the records leading to the issuance of original Bank attachment notice bearing reference GSTIN 33ACIPV9406H1ZB dated 26.02.2024 by the 1st respondent to the 2nd respondent and quash the same.

In both WPs.

For Petitioner : Ms.Sri Harini S.P.

For R1 : Mr.V.Prashanth Kiran, Govt. Adv. (T)

C O M M O N O R D E R

The petitioner assails both an assessment order dated 24.07.2023 and a consequential bank attachment notice dated 26.02.2024.

- The petitioner is engaged in the business of supply of bricks, blocks, tiles and ceramic goods. The petitioner asserts that he is uneducated and computer illiterate. Therefore, it is further asserted that the petitioner was unaware of proceedings commencing from the issuance of an intimation dated 19.01.2023 and culminating in the impugned assessment order dated 24.07.2023.

- Learned counsel for the petitioner invited my attention to the impugned assessment order. With reference to defect 1, she pointed out that the assessing officer concluded that no further action is required. As regards defect 2, she pointed out that the petitioner had claimed Input Tax Credit (ITC) of Rs.54,000/- each for SGST and CGST in the GSTR 3B return, whereas the auto-populated GSTR 2A return reflected the availability of ITC to the extent of Rs.3,23,967/- each towards SGST and CGST. In those circumstances, she submits that the conclusion that the petitioner wrongly availed of eligible ITC is patently wrong and indicates complete non application of mind. As regards the liability to pay interest, she points out that the sum of Rs.3,97,353/- each towards SGST and CGST was remitted on 06.03.2024. In conclusion, learned counsel points out that a sum of Rs.10,86,310/- was appropriated towards the demand under the impugned assessment order from the petitioner’s bank account in the Canara Bank.

- Mr.V.Prashanth Kiran, learned Government Advocate, accepts notice for the 1st respondent. He points out that both the intimation and show cause notice were served on the petitioner by post and not merely uploaded on the GST portal. Therefore, he submits that principles of natural justice were clearly complied with.

- On perusal of the impugned assessment order, it is evident that the petitioner availed of a lower amount as ITC than the amount reflected in the auto-populated GSTR 2A return. In those circumstances, the conclusion that the petitioner wrongly availed of ITC indicates non application of mind. As regards the interest liability for belated filing of returns, the evidence on record reflects that the petitioner remitted sums of Rs.3,97,353/- each towards CGST and SGST on 06.03.2024. In these circumstances, the impugned order calls for interference.

- Therefore, the impugned assessment order is quashed and the matter is remanded to the assessing officer for reconsideration. The petitioner is permitted to file a reply to the show cause notice dated 24.07.2023 within a period of two weeks from the date of receipt of a copy of this order. Upon receipt thereof, the assessing officer is directed to provide a reasonable opportunity to the petitioner, including a personal hearing, and thereafter issue a fresh assessment order within a period of two months from the date of receipt of the petitioner’s reply. Since the sum of Rs.10,86,310/- was appropriated from the petitioner’s Canara Bank account, the attachment notice issued to recover the tax demand shall stand raised and the amount appropriated shall abide by the outcome of the remanded proceedings.

- These writ petitions are disposed of on the above terms. There will be no order as to costs. Consequently, connected miscellaneous petitions are closed.

14.03.2024

Index : Yes / No

Internet : Yes / No Neutral Citation : Yes / No kj

To

1.The State Tax Officer, Suramangalam Assessment Circle, Salem.

2.The Branch Manager,

Canara Bank,

Suramangalam Branch, Salem-636 005.

SENTHILKUMAR RAMAMOORTHY,J.

Kj

W.P.Nos.6772 & 6776 of 2024

and W.M.P.Nos.7543, 7545, 7548 & 7551 of 2024

14.03.2024