THE HON’BLE MR. SANJAY V. GANGAPURWALA, CHIEF JUSTICE AND THE HON’BLE MR.JUSTICE D.BHARATHA CHAKRAVARTHY W.P.Nos.13455,13554, 14419,15405, 21691, 21696, 24159, 24163 of Satguru Complex, 640, Anna Salai, Nandanam, Chennai – 600 035. 4.Assistant Commissioner of Income Tax, Central Circle-1(1), Chennai – 34. … Respondents For Petitioner(s) : Mr. J.D. Mistry, Senior Counsel, Assisted by Mr. R. Sivaraman & M/s.Vandanay Vyas (in W.P.Nos.13554 & 13445 of 2021 & 23856 of 2023) For Petitioner(s) : Mr. P.S. Raman, Senior Counsel, Assisted by Mr. R. Sivaraman (in W.P.No.21691 of 2021 & 21696 of 2021) For Petitioner(s) : Mr. R. Sivaraman (for rest of the W.P’s) For Respondent (in all cases) : Mr. Prabhu Mukunth Arunkumar, (for R3) : Mr. A.R.L. Sundaresan, (for R1) Additional Solicitor General of India. Assisted by Mr. Rajesh Vivekanathan, Deputy Additional Solicitor General of India. : Mr. A.P. Srinivas, (for R2 & R4) Senior Standing Counsel. : and Mr. ANR. Jayaprathap, Junior Standing Counsel. COMMON ORDER (Order of the Court was made by Mr. Justice. D.Bharatha Chakravarthy)

[ IN THE HIGH COURT OF JUDICATURE AT MADRAS

[ IN THE HIGH COURT OF JUDICATURE AT MADRAS

Date : 17.11.2023

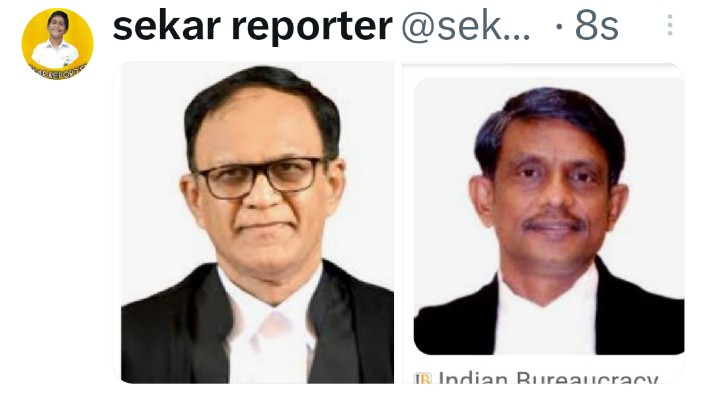

CORAM :

THE HON’BLE MR. SANJAY V. GANGAPURWALA, CHIEF JUSTICE

AND

THE HON’BLE MR.JUSTICE D.BHARATHA CHAKRAVARTHY

W.P.Nos.13455,13554, 14419,15405, 21691, 21696, 24159, 24163 of

2021;

W.P.Nos.4928, 4935, 5252, 5255 of 2022;

W.P.Nos.23856, 23867, 23874, 24537, 25550, 25854, 25859, 26004, 26007 & 27528 of 2023 and

WMP.Nos.14329, 14330, 14331, 14425, 14426, 14427, 15321,15323, 15325, 16296, 16297, 16302, 22869, 22876, 22878, 25483, 25486, 25489 of 2021;

WMP.Nos.5076, 5077, 5080, 5081, 5343,5344,5349, 5350 of 2022;

WMP.Nos.23370, 23371, 23378, 23379, 23383, 23384, 23954, 23956,

24939, 24940, 25859, 25297, 25301,25304, 26007, 25426, 25431, 25436,

26968, and 26969 of 2023

In W.P.No.13455 of 2021:

M/s. Jain Metal Rolling Mills,

Represented by its Chief Financial Officer,

Mr. Hemanth S Jain,

The Lattice, 4th Floor,

No.20, Waddles Road, Kilpauk,

Chennai – 600 010. … Petitioner

Versus

1.Union of India,

Represented by its Secretary,

Ministry of Finance,

Department of Revenue,

3rd Floor, Jeevan Deep Building,

Sansad Marg, New Delhi – 110 001.

2.The Central Board of Direct Taxes,

Represented by its Chairperson,

Department of Revenue – Ministry of Finance, Government of India, New Delhi.

3.Interim Board of Settlement,

Represented by its Secretary,

Replacing the Income Tax Settlement Commission,

Additional Bench, Chennai,

Represented by its Secretary,

Satguru Complex,

640, Anna Salai, Nandanam, Chennai – 600 035.

4.Assistant Commissioner of Income Tax,

Central Circle-1(1),

Chennai – 34. … Respondents

For Petitioner(s) : Mr. J.D. Mistry, Senior Counsel,

Assisted by Mr. R. Sivaraman & M/s.Vandanay Vyas

(in W.P.Nos.13554 & 13445 of 2021 & 23856 of 2023)

For Petitioner(s) : Mr. P.S. Raman, Senior Counsel,

Assisted by Mr. R. Sivaraman

(in W.P.No.21691 of 2021 & 21696 of 2021)

For Petitioner(s) : Mr. R. Sivaraman (for rest of the W.P’s)

For Respondent

(in all cases) : Mr. Prabhu Mukunth Arunkumar, (for R3)

: Mr. A.R.L. Sundaresan, (for R1) Additional Solicitor General of India.

Assisted by Mr. Rajesh Vivekanathan,

Deputy Additional Solicitor General of India.

: Mr. A.P. Srinivas, (for R2 & R4) Senior Standing Counsel.

: and Mr. ANR. Jayaprathap,

Junior Standing Counsel.

COMMON ORDER

(Order of the Court was made by Mr. Justice. D.Bharatha Chakravarthy)

All these writ petitions are connected to each other and are filed with two sets of prayers. The petitioners pray for a writ of declaration, declaring the amendment to the Income Tax Act, 1961 in Section 245-A by inserting Sub-Clause (da), (ea) and (eb), 245B, 245BC,245BD, proviso to

245C, 245D, 245DD, 245F, 245G, 245H and insertion of new Section 245AA and 245M by way of Sections 54 to 65, Finance Act, 2021 with retrospective effect from 01.02.2021 as arbitrary, illegal and void and infringing the fundamental rights conferred under Article 14,19(i)(g), 20, 20 (2) and 21 of the Constitution of India, 1950, thus unenforceable and unconstitutional.

2.The petitioners also challenge the order issued by the Department of Revenue, Ministry of Finance, in F.No.299/22/2021-Dir(Inv.III)/174 dated 28.09.2021 in as much as it restricted the filing of the application before the Interim Board for Settlement only by the assesses who were eligible to file the application for settlement on 31.01.2021.

3.The factual background of the case is that the petitioners are all assessees of Income Tax. The matters pertaining to assessments and reopening etc., were pending and they have either approached or contemplating approaching the Settlement Commission as per Chapter XIX-A of the Income Tax Act, 1961 (hereinafter the Act). Originally, under Chapter XIX-A of the Act, the eligible assessees were entitled to approach the Settlement Commission (hereinafter ITSC) at any stage of a case relating to them and the ITSC will consider their cases as per the parameters and will grant relief by passing orders providing for the terms of settlement of the case. Thus, the eligible assessees had the additional option of resolution of the dispute by approaching ITSC. According to the petitioners, they are eligible and their cases are complex in nature and it would be uncertain to pursue the regular remedies and it would be

beneficial for them to settle the issue.

4.While so, by the Finance Act, 2021, which was notified on 01.04.2021, the ITSC was abolished and an Interim Board was constituted to deal with the pending applications. A proviso to Section 245B was inserted which reads as follows :-

“Provided that the income tax settlement commission so constituted shall cease to operate on or after the first day of February 2021”

Section 245C(5) inserted by the Act, mandated that no application shall be made under this section on or after the first day of February, 2021, which reads thus:-

“(5). No application shall be made under this section on or after the 1st day of February 2021.”

5.The Finance Act, 2021, was made retrospective in operation with effect from 01.02.2021. The reason which was mentioned for the said cut-off date is that the Bill was introduced in the Parliament on the said date. However, as per the existing provisions, in the month of February and March, 2021, in respect of their ‘cases’ the petitioners had made applications before the ITSC.

6.Be that as it may, considering the difficulty of the assessees, on account of the sudden and retrospective amendment, in exercise of its powers under Section 119(2) of the Act, a press release was issued on

07.09.2021 and thereafter an Order in the nature of a Trade Circular was issued on 28.09.2021 extending the time limit for filing applications before the Interim Board upto 30.09.2021. However, paragraph (4) of the said

Order reads thus:-

“4. The above relaxation is available to the applications filed:-

(i) by the assessees who were eligible to file application for settlement on 31.01.2021 for the assessment years for which the application is sought to be filed (relevant assessment years); and

(ii) where the relevant assessment proceedings of the assessee are pending as on the date of filing of the application for settlement. “

7.As a matter of fact, immediately after the introduction of the Bill before the Parliament, fresh applications were not accepted before the ITSC as such, several petitioners had approached the Courts of law and upon directions of Court their applications were received and are pending. After the extension of time upto 30.09.2021, in some cases, the applications were rejected on the ground that the Orders/Notices of reopening etc., were issued on or after 01.02.2021, by considering the eligibility clause as contained in the circular dated 28.09.2021. Hence, the aggrieved petitioners are before this Court, broadly with the above prayers challenging the Constitutional Validity of the provisions of the Finance Act, 2021, as also challenging the validity of the Circular dated 28.09.2021 and the consequential orders that are passed in their individual cases.

8.It is the case of the Writ Petitioners that their statutory remedy of approaching the ITSC, cannot be taken away retrospectively. Retrospective legislation cannot affect the vested rights. It also overrides the directions of Courts issued in the interregnum. As such, the provisions as aforementioned in the prayer are unconstitutional. Similarly, the Department is entitled to prescribe the last date even beyond the original cut-off date as prescribed by the legislation. Accordingly, when it has extended the last date from 01.02.2021 to 30.09.2021, it can only extend the deadline but cannot introduce a new concept of ‘eligibility as on 01.02.2021’ which is not there in the Act itself. To the said extent, the impugned circular is illegal.

9.The Writ Petition is resisted by the respondents by filing a common counter affidavit. It is the case of the respondents that the Parliament was well within its powers to abolish the ITSC. To have the matter settled before the commission is only a concession and not a right. Thus, nobody had any vested right regarding the instant claims and therefore there is no question of interfering with any such vested right. Retrospectivity by itself will not invalidate the law. As a matter of fact, the bill was introduced as of 01.02.2023, from which date itself everyone concerned was aware of the move to abolish the ITSC and therefore, the

Interim Board is constituted only to deal with applications pending as of 01.02.2023. Beyond the said point, nobody can have any right. The right to file an application before the ITSC would itself arise only if proceedings were pending as of 31.01.2023 and if the proceedings were initiated after the cut-off date, there was no question of approaching ITSC. In that view of the matter, while extending the time limit, which was again a concession only to mitigate the hardship, due care was taken and the extension of last date was made conditional upon their right being crystallised as on 31.01.2023 as the intention was only to extend the last date not the operation of the provisions of ITSC beyond the date of its abolition.

10.We have heard the Learned Counsel Appearing on behalf of the Petitioners. Mr. J.D.Mistry, the Learned Senior Counsel led the arguments on behalf of the petitioners in detail, while the other Learned Counsel adopted and supplemented to his submissions. Mr. A.R.L. Sundaresan, the Learned Additional Solicitor General of India, argued on behalf of the respondents.

11. Mr.J.D. Mistry, the Learned Senior Counsel after taking us through the specific facts in respect of W.P. No.13554 of 2021, would submit that it can be seen that in all these matters searches were conducted and documents were called for well before 31.01.2021. For the reasons best known to them, the authorities issued the notice of re-opening only after 31.01.2021 and thus, the very right of approaching the ITSC now in the scheme of things stood dependent on the vagaries of action being taken by the authorities as per their convenience. In any event, the impugned enactment came to be notified only on 01.04.2021. He would submit that

‘Case’ is defined under Section 245A(b) as under :-

“(b) “Case” means any proceedings for assessment under this act of any person in respect of any assessment here or assessment years which may be pending before the assessing officer on the date on which the application under subsection (1) Hema of section 245C is made.”

12.He would refer to the definition of ‘Pending Application” as per

Section 245A(eb) which reads as under :-

“(eb) “pending application” means an application which was filed under section 240 5C, and which fulfills the following conditions namely:-

(i) it was not declared invalid under sub-section (2C) of section 245D; and

(ii) no order under sub-section(4) Section

245D was issued on or before the 31st day of January

2021, with respect to such application:”

13.He would then advert to Section 245D, which is extracted below:-

“245D. (1) On receipt of an application under section 245C, the settlement commission shall within seven days from the date of receipt of the application, issue a notice to the applicant requiring him to explain as to why the application made by him be allowed to be proceeded with, and on hearing the applicant, the settlement commission shall, within a period of 14 days from the date of application, by an order in writing, reject the application or allow the application to be proceeded with:

Provided that where no order has been passed within the force period, by the settlement commission, the application shall be deemed to have been allowed to be proceeded with”

14.Further placing reliance on Section 245M, he would submit when the Board had to transfer all the pending applications to the Interim Board, nowhere any date of eligibility or a cut-off date is mentioned. Therefore he would submit that the circular while extending the time for making the applications upto 30.09.2021, ought not to have introduced a new condition of eligibility and to the said extent, the circular has to be read down as discriminatory and violative of the Act.

15.In support of his submissions, the Learned Senior relied upon the Judgment of the Bombay High Court in, Tata Iron and Steel Co. Ltd -Vs- N.C. Upadhyay , more specifically on paragraph 23 which reads as follows:-

“23. …. While so holding, we must, however, strike a note of caution that the binding nature of the circular issued by the central board of revenue must be confined to tax laws and that also for the purpose of giving administrative relief to the taxpayer and not for the purpose of imposing a burden on him. ….”

16.The Judgment of the Supreme Court of India in, Reliance Jute Industries Ltd -Vs- Commissioner of Income Tax2, was relied upon, referring to paragraph 6 to contend that it is a cardinal principle of the tax law that the law to be applied is that which is in force for the assessment year unless otherwise provided expressly or by necessary implication. The assessees had a vested right to approach ITSC as per the law in force for the assessment year.

17.He would further rely upon the Judgment of the Supreme Court of India in, Uco Bank -Vs-Commissioner of Income Tax3, of which the relevant portion of the paragraph 18 is extracted hereunder for ready reference :-

“18. …. The relevant circular of CBDT cannot be ignored. The question is not whether a circular can override or detract from the provisions of the act; the question is whether this circular seeks to mitigate the rigour of particular section for the benefit of the assessee in certain specified circumstances. So long as such a circular is enforce, it would be binding on the departmental authorities in view of the provisions of Section 119 to ensure a uniform and proper administration and application of the Income Tax Act.”

18.The Learned Senior Counsel also relied upon Godrej and Boyce Manufacturing -Vs- State of Maharashtra & others4, for the proposition additional condition of eligibility, cannot be brought in by the circular and the relevant portion paragraph 64 referred is reproduced below :-

“64. ….. Therefore, surrender of the land in terms of clause (b) of section 126(1) of the act cannot be subjected to any further conditions other than those already provided for in the statutory provisions. It is of course open to the legislature to add to the conditions provide for in the statute, (or for that matter to do away with certain conditions that might be in existence). But it

31999 104 TAXMAN 547 SC

https://www.mhc.tn.gov.in/judis4 2009 5 SCC 24

certainly cannot be left in the hands of the executive to impose conditions in addition to those in the statutes for accepting the offer to surrender the designated land.”

Thus, he would submit that when the applications of the petitioners have been treated as pending applications, the circular is without application of mind and as such is arbitrary and has to be accordingly read down by this Court.

19.Regarding the constitutionality of the impugned enactment, the learned senior counsel would submit that the vested rights cannot be taken away retrospectively. The right to approach the ITSC is a statutory right vested in the writ petitioners. The legislature while doing away with the ITSC ought not to have taken away these vested rights. In support of the said submission, the Learned Senior Counsel would rely upon the Judgment of the Supreme Court of India in, Commissioner of Income Tax -Vs- Shah Sadiq & Sons5. Relevant portion of paragraph 14 relied upon is extracted hereunder ready reference:-

“14. …A right which had accrued and had become vested, continued to be capable of being enforced, notwithstanding the repeal of the statute under which the right accrued unless the repealing statute took away the

https://www.mhc.tn.gov.in/judis5 1978 31 TAXMAN 498 SC

right expressly or by necessary implication. This is the effect of Section 6 of the General Class Act, 1897.”

20.The Learned Senior Counsel further relied upon the Judgment of the Supreme Court of India in, Punjab State Cooperative Agriculture Development Bank Limited -Vs- The Registrar of Cooperative Society and others , and the relevant paragraph 47 reads as under :-

“47. The exposition of legal principles culled out is that an amendment having retrospective operation, which has the effect of taking away the benefit already available to the employee under the existing rule, indeed divest the employee from his vested or accrued rights and that being so, it would be held to be violative of the rights guaranteed under Article 14 and 16 of the Constitution”

21.The Judgment in, Union of India & Others -Vs- Tushar Ranjan Mohanty and others7, is pressed into service for the proposition that when the petitioners’ applications were taken on file pursuant to orders of Courts of law, then the retrospective legislation which makes the relief obtained nugatory would be illegal. The relevant passage in paragraph 14 is as follows :-

“14. The legislatures and the competent authority under Article 309 of the Constitution of India have the power to make laws with retrospective effect. This power, however, cannot be used to justify the arbitrary, illegal or unconstitutional acts of the executive. A person is deprived of an accrued right vested in him under a statute or under the Constitution and he successfully challenges the same in a court of law, the legislature cannot render the said right and the relief obtained nugatory by enacting retrospective Legislation.”

22.Further reliance was made on, Association of Old Settlers of Sikkim -Vs- Union of India8, for the proposition that when a vested benefit is extended under a statute, the provision which takes away such vested benefit retrospectively should have a rationale and in the particular case, the mere date of introduction of the bill is prescribed, which is without any rationale whatsoever. The relevant portion of paragraph 102 reads as under:-

“102. …. Thus, those Sikkimese women who had the benefit of exemption have been deprived by the same with effect from 1-4- 2008. The retrospectivity of the proviso takes away a vested benefit extended to such category of woman covered under the proviso with effect from 1-4-1990 without their being a rationale for the same.”

https://www.mhc.tn.gov.in/judis8 2023 451 ITR 213

23.The second submission made on behalf of the petitioners to attack the constitutional validity is that the cut-off date fixed by the impeachment as 01.02.2021 is discriminatory. Mr. J.D.Mistry, the Learned

Senior Counsel would submit that it’s a general practice that every year the Financial Bill is introduced in respect of the changes to be made for the subsequent financial year starting from the first April of that year. Therefore, the date of introduction of the Bill as such has no nexus whatsoever regarding the purposes of the Act. The purpose of the Finance Act, 2021 was to do away with the ITSC which was made by the recommendation of the Wanchoo Committee and therefore the cut-off date is Arbitrary.

24.The Learned Senior Counsel would rely upon the Judgment of the Supreme Court of India in the case of D.S. Nakra -Vs- Union of India9, to contend that the cut-off date discriminates between the class of homogeneous persons. The classification if it is made on the cut-off date of 01.02.2021, would only be artificial and the ‘pending applications’ will have to be read as not pending and as such, the classification is capricious,

https://www.mhc.tn.gov.in/judis9 1983 AIR SC 130

whimsical and thus violative of Article 14 of the Constitution of India.

Relevant portion of paragraph 42 of D.S. Nakara, is extracted hereunder :-

“42. If it appears to be undisputable, as it does to us that the pensioners for the purpose of pension benefits form a class, would its upward revision permit a homogeneous class to be divided by arbitrarily, fixing an eligibility criteria unrelated to purpose of revision, and would such classification be founded on some rational principle? The classification has to be based, as is well settled, on some rational principle, and the rational principle must have nexus to the objects sought to be achieved.

…”

25.On behalf of the petitioners, the decision of the Learned Single Judge of the Calcutta High Court in W.P.A.No.3048 of 2022, along with the Order of stay granted by the Division Bench in M.A.T.No.375 of 2022 are also produced.

26.On the basis of all the above, the learned Senior Counsel would submit that the grievance of the petitioners will stand addressed even by reading down of circular. In the event of the circular being found to be in order, the petitioners press for the submissions relating to the unconstitutionality of the impugned provisions.

https://www.mhc.tn.gov.in/judis

27.Per contra, Mr. A.R.L.Sundaresan, the Learned Additional Solicitor General of India, would submit that the purpose of the impugned legislation itself is to do away with the ITSC and to set up an Interim Board to deal with the pending applications. After taking this Court through the then existent settlement scheme and the right to approach the ITSC, he would submit that the very object of the amendment itself is to abolish the ITSC. The Finance Act, 2021 received the assent of the President on 28.03.2021 and was published in the gazette and notified on

01.04.2021. However, it was expressly given retrospective effect from 01.02.2021. The assessees do not have any vested right for settlement and the settlement itself is a concession. The Parliament has got power to give retrospective effect to such laws and mere retrospectivity will not render the laws bad. The very concept of settlement is only for the benefit of Revenue, to ease and expedite the collection.

28.The Circular merely extended the time for submitting the applications and nothing beyond. As per the Act itself, the petitioners were eligible to file applications only if their case is pending as on

01.02.2021 and the pending applications are to be transferred to the

Interim Board. Thus, it goes without saying that only the applications

https://www.mhc.tn.gov.in/judis

which are eligible and filed before 01.02.2021 alone are to be dealt with by the Interim Board. The introduction of the abolition of settlement scheme or resolution scheme is the legislative policy and the same cannot be challenged and the scope of judicial review in respect of the same is very limited.

29.In support of his submissions, the Learned Additional Solicitor General of India, relied upon the Judgment of the Supreme Court of India in, State of Madhya Pradesh -Vs- Rakesh Kohli & another10, more specifically on paragraphs 16, 17 and 32, and the relevant portions as under:-

“16. The statute enacted by Parliament or a State Legislature cannot be declared unconstitutional lightly. The court must be able to hold beyond any iota of doubt that the violation of the constitutional provisions was so glaring that the legislative provision under challenge cannot stand. Sans flagrant violation of the constitutional provisions, the law made by Parliament or a State Legislature is not declared bad ”

“17. This Court has repeatedly stated that legislative enactment can be struck down by Court only on two grounds, namely (i), that the appropriate Legislature does not have competency to make the law and(ii), that it does not take away or abridge any of

https://www.mhc.tn.gov.in/judis10 2012 (6) SCC 312

the fundamental rights enumerated in Part – III of the Constitution or any other constitutional provisions..”

“32. While dealing with constitutional validity of a taxation law enacted by Parliament or State Legislature, the court must have regard to the following principles:

(i), there is always presumption in favour of constitutionality of a law made by Parliament or a State Legislature.

(ii), no enactment can be struck down by just saying that it is arbitrary or unreasonable or irrational but some constitutional infirmity has to be found.

(iii), the court is not concerned with the wisdom or unwisdom, the justice or injustice of the law as the Parliament and State Legislatures are supposed to be alive to the needs of the people whom they represent and they are the best judge of the community by whose suffrage they come into existence(iv), hardship is not relevant in pronouncing on the constitutional validity of a fiscal statute or economic law and…

(v), in the field of taxation, the Legislature enjoys greater latitude for classification.”

30.The Learned Additional Solicitor General of India would submit that there was no vested right of settlement even prior to the amendment and thus it cannot be deemed to be preserved by the provisions of Section 6 of the General Clauses Act and the assessees have other remedies of appeal etc., under the Act. In support thereof, the Judgment in, N.S.

https://www.mhc.tn.gov.in/judis

Shivananda -Vs- Karnataka State Road Transport Corporation &

others11, is pressed into service. Paragraph 15 reads as follows :-

“ “15. The distinction between what is, and what is not a right preserved by the provisions of Section 6 of the General Clauses Act is often one of great fineness. What is unaffected by the repeal of a statute is a right acquired or accrued under it and not a mere “hope or expectation of”, or liberty to apply for, acquiring a right. In Director of Public Works v. Ho Po Sang [(1961) 2 All ER 721, 731 (PC)] Lord Morris speaking for the Privy Council, observed:

“It may be, therefore, that under some repealed enactment, a right has been given but that, in respect of it, some investigation or legal proceeding is necessary. The right is then unaffected and preserved. It will be preserved even if a process of quantification is necessary. But there is a manifest distinction between an investigation in respect of a right and an investigation which is to decide whether some right should be or should not be given. On a repeal, the former is preserved by the

Interpretation Act. The latter is not.”

(emphasis supplied)

It must be mentioned that the object of Section 31(2)(i) is to preserve only the things done and action taken under the repealed Ordinance, and not the rights and privileges acquired and accrued on the one side, and the corresponding obligation or liability incurred on the other side, so that if no right acquired under the repealed Ordinance was preserved, there is no question of any liability being enforced”

https://www.mhc.tn.gov.in/judis11 1980 (1) SCC 149

31.Mr. A.R.L.Sundaresan, the Learned Additional Solicitor General of India would submit that even assuming that there was a right to approach ITSC, the parliament which conferred the right has the power to take away the same. Reference was made to the Judgment in, Commercial Tax Officer -Vs- Viswanathan Junjunwala and others , whereby the amendment by which the suo moto power of the Assessing Authority was taken away was held to be valid. Further reliance was made to R.C. Tobacco Pvt. Ltd. -Vs- Union of India13, to contend that not only there is power to amend, repeal or supersede, such powers can be exercised retrospectively also. The exercise cannot be unreasonable because the restrospectivity was only 2 months and no unforeseen financial burden arises on account of such amendment. Paragraphs 20, 21, 22, 28 and 29 were referred to. The necessary passages are extracted below:-

“20. The competence of parliament and the State legislatures to repeal, amend or supersede an exemption notification is unquestionable. The power to do so retrospectively cannot be and is also not doubted. ……

21. A law cannot be held to be unreasonable, merely because it operates retrospectively. ……

…The unreasonability must lie in some other additional factors. The retrospective operation of a statute would have to be found to be unduly oppressive and confiscatory before it can be held to be so unreasonable as to violate the constitutional

norms……

22. The factors which are generally considered relevant in answering this question are: (I) the context in which the retrospectivity was contemplated; (ii) to the period of such retrospectivity and ; (iii) the degree of any unforeseen or unforeseeable financial burden imposed for the past period……

28. Although the length of time is not by itself decisive (2003 5 SCC 23) the effect of the retrospectivity of the legislation in this case is less then two years….”

32.In Garikapatti Veeraya -Vs- N. Subbiah Chowdry& others , it was held that the vested right of appeal can be taken away by the subsequent enactment, if it so provides expressly or by necessary intendment and not otherwise. For the same proposition, reference was also made to paragraphs 20-23 of Kamal Kumar Datta -Vs- Ruby General Hospital Ltd.15,. The Learned Additional Solicitor General of India would submit that in any event, ITSC was a concession shown on erring assessees and such concessions can be withdrawn at any time in public interest.

Reference was made to paragraphs 49, 50 and 51 of the Judgment in, Tamilnadu Electricity Board -VS- Status Spinning Mills Ltd., .

33.As far as the circular is concerned, Mr. A.R.L.Sundaresan, the Learned Additional Solicitor General of India, would contend that it is for the Court to declare what the provisions of the statute say and the circular merely portrays understanding of the executive of the import of the legislation and the same is only binding on the officers of the department.

For this purpose, he would rely upon the Judgment, in Commissioner of Central Excise, Bolpur -Vs- M/s.Ratan Melting and Wire Industries17, more specifically referring to paragraph No.6. Finally, the Learned Additional Solicitor General of India would conclude his arguments by submitting that these are matters relating to policy of taxation and economy. Once the decision has been taken to do away with the ITSC with effect from 01.02.2021, thereafter, no right whatsoever can be claimed otherwise by making technical arguments. Therefore, he would submit that all these Writ Petitions may be dismissed.

34.We have considered the rival submissions made on either side and perused the material records of the cases. The following three questions arise for consideration in the present cases :-

(i) Whether or not paragraph No.4(i) of the Circular, dated 28.09.2021 is bad in law inasmuch as it imposes a condition of eligibility to file application for settlement as on 31.01.2021 ?

(ii) Whether or not the Finance Act, 2021 is unconstitutional inasmuch as it has given retrospective application with effect from 01.02.2021?

(iii) To what reliefs, the petitioners are entitled ?

Question No.i :

35.The impugned circular is issued in the exercise of power under Section 119(2) of the Act. The offending clause 4(i) is extracted supra in paragraph No.6 above. On a consideration of the decisions relied on by both sides and submissions made, to answer the question in the present context of the case, it is clear that a circular issued by the respondents under Section 119 of the Act: (i) would be binding on the departmental authorities; (ii) It is issued to ensure uniform and proper administration and the application of the Income Tax Act; (iii) It cannot add any new condition or anything contrary to the statute; (iv) But, in order to mitigate the rigor of the provisions for the benefit of the assessees in certain specified circumstances, it can even travel beyond so as to grant administrative relief to the taxpayer, but, it shall not impose any new burden on him.

36.In that conspectus, with the Finance Act, 2021, in the background as such, it can be seen that by virtue of proviso to Section 245B, the ITSC is made inoperative with effect from 01.02.2021. Similarly, the Section 245C(5) also plays an embargo that no application shall be made under the section on or after 01.02.2021. The proviso to Section 245D(2C) deems that if no order is passed as on 31.01.2021 under the section, the application is deemed to be valid. The powers of the ITSC under Sections 245DD, 245F, 245G, 245H are all specifically entrusted to be exercised by the Interim Board with effect from 01.02.2021. Further, Sections 245D(9), stipulates that from 01.02.2021, the provisions of Sub-Sections (1)(2)(2B), (2C), (3), (4), (4A), (5), (6) and (6B) shall apply to pending applications allotted to Interim Board with the modifications mentioned therein. In this background, the circular can only grant administrative relief to the assessees. Therefore, considering the fact that the Finance Act, 2021 was retrospective in nature. Those who have had a right to approach ITSC i.e., those who had a case pending against them would have missed the bus in not actually filing the application before the ITSC as the same was retrospectively made inoperative. Only for the said action of filing the application, the circular extend the date by 30.09.2021, even though as per the Act, it was only 01.02.2021. In that context, when paragraph No.4 categorically states that only those assessees who are eligible to file an application for settlement as on 31.01.2021, it cannot be said that it introduces an additional clause of eligibility which is not found in the statute. On the other hand, if only such clause 4(i) is not there, it would render violence to the Finance Act, 2021. Therefore, we are unable to accept the contentions on behalf of the writ petitioners that the circular imposes an additional condition of eligibility which is not there in the statute. Even though there is no specific provision regarding eligibility, the right to approach the ITSC can be exercised so long as the ITSC is operational in law. When ITSC itself has been made inoperative with effect from 01.02.2021, it cannot be said that clause 4(i) of the circular runs counter or imposes an additional condition to the statute.

Accordingly, Question No.i is answered.

Question No.ii :

37.The basic ground of attack on the constitutionality of the impugned enactment is that it is retrospective in nature and that it takes away the vested rights of the petitioners. The further submission is that the vested rights are taken away by fixing an artificial cut-off date. In this regard, the contention on behalf of the State is that the settlement itself is concession and therefore, the writ petitioners cannot claim any vested right. We are unable to countenance the said argument on behalf of the State. It may be true that the orders passed by ITSC containing terms of settlement has the trappings of concession and benevolence showered by the State to a particular assessee. But, such benevolence, concession etc., are exercised by the State through a statutory regime. Under the statute, the assessees are entitled to approach the appropriate authority seeking such concession/benevolence. Therefore, the question with which we are concerned is the ‘right to approach’ the ITSC which is a statutory right conferred by Chapter XIX-A of the Act, more specifically, Section 245C of the Act by filing an application. Therefore, the assessees had a statutory right to approach the ITSC. Like any other appellate or revisional remedy which is a creature of statute, to right to seek resolution through ITSC was also conferred by the statute. Of course, it is well within the policy realm of the State to take away the remedy. It is not for this Court to substitute its opinion as to the abolition of the ITSC and taking away the procedure of resolution of the disputes through ITSC under Chapter XIX-A. The State had every right to abolish the ITSC. Therefore, the Parliament had every right to enact impugned enactment. While being so, in appropriate cases, the right to enact a law with retrospective operation is also well recognized. In the instant case, on a perusal of the impugned legislation, it was given retrospective effect with effect from 01.02.2021 on the premise that it is on the said date, that the Bill was introduced by the Parliament, by which, all the assessees and the general public concerned are made to know about the policy decision in the making by which the State proposed to make the ITSC inoperative. The period of retrospectivity is also only two months as it can be seen that the Act itself was notified on 01.04.2021. It is also not regarding any levy of tax to contend that the parties acted as per the law in force at the relevant time. Therefore, the act of the State in abolishing the ITSC with effect from a cut-off date per se cannot be illegal or ultra vires the Constitution.

38.But, at the same time, the ITSC did exist legally and factually until 31.03.2021. Every eligible assessee had a right to approach the ITSC, if they had a ‘case’ pending against them. The definition of ‘case’ as per Section 245-A(eb) is also extracted above. Therefore, even if any proceeding for assessments/reopening is issued after 01.02.2021 upto 31.03.2021, the assessee had a ‘case’ to approach the Commission and if they had submitted an application and if no final order has been passed under Sub-Section 4 of 245(D) on or before 31.01.2021, then the said application is treated as a ‘pending application’. The very purpose of the legislation was to abolish the ITSC and to establish an Interim Board to deal with the pending applications. It can be seen that in respect of the case of the petitioners whose matters had arisen before the notification of the Act on 01.04.2021, but, after the cut-off date of 01.02.2021, were also very much eligible to approach the ITSC. The decisions relied upon by both sides in respect of retrospective legislation referred to supra, unequivocally hold that if the retrospective legislation takes away a vested right, it must do so by providing expressly or by necessary intendment. We step back and read the Amending Act namely, the Finance Act, 2021 carefully. While the ITSC is made inoperative with effect from 01.02.2021 and an Interim Board is set up, provisions are made to transfer pending applications, absolutely, the Amending Act or the entire Chapter XIX-A as it stands after the amendment, does not expressly deal with or provide anything by necessary intendment regarding those applications which are made or the eligible cases in the interregnum. This being so, the ratio of the Judgment of the Hon’ble Supreme Court of India, in Commissioner of Income Tax -Vs- Shah Sadiq & Sons (cited supra) would apply in all force that a right which had accrued to approach the ITSC till the notification of the Finance Act, 2021 on 01.04.2021 stood vested in the eligible assessees and the said rights continued to be capable of being enforced notwithstanding the amendment of the relevant provision.

39.As a matter of fact, the applications are either made by the petitioners or on direction by the orders of the Court as the ITSC was in the statute book in the interregnum period before the retrospective legislation came into force. Therefore, the retrospectivity also makes these directions of Court and the consequential applications being filed before the ITSC nugatory. Therefore, the ratio in Tushar Ranjan Mohanty quoted supra

applies in all force.

40.At the material time, i.e., during the interregnum period of 01.02.2021 upto 31.03.2021, the petitioners had a “case” within the definition of Section 245A(b). Their applications were very much pending applications as per the definition of 245A(eb). As a matter of fact, their

applications were dealt with as per Section 245D and on a perusal of Section 245M, it can be seen that these applications were also to be transferred to the Interim Board to be dealt with in accordance with the procedure laid down to the board. But, however, without amending the definition of case pending applications etc., Section 245C(5) simply provides that no application shall be made under the Section on or after the first day of February, 2021. The right to file application before ITSC is very much existent and has been exercised till 31.03.2021. The

retrospective legislation by way of legal fiction attempts to make it as if it is unavailable. In this regard, useful reference can be made to the Judgment of the Hon’ble Supreme Court of India in Karnataka State Road Transport Corpn., -Vs- B.A. Jayaram18, and the relevant portion of paragraph 17 reads as follows:-

“17.Even if sub-section (8) of Section 57 can be viewed as creating a legal fiction, the question which would arise would be for what purpose such legal fiction was created. As was observed by Lord James in Ex Parte Walton, In re Levy[(1881) 17 Ch D 746, 756 : (1881-85) All ER Rep 548 : 45 LT 1 (CA)] :

“When a statute enacts that something shall be deemed to have been done, which in fact and in truth was not done, the Court is entitled and bound to ascertain for what purposes and between what

persons the statutory fiction is to be resorted to.” This passage was quoted with approval by the

https://www.mhc.tn.gov.in/judis18 1984 Supp SCC 244

House of Lords in Hill v. East & West India Dock

Co.[(1884) 9 AC 448, 456 : 51 LT 163 : 32 WR 925 (HL)] This principle of statutory interpretation has been accepted by this Court. In Bengal Immunity Co. Ltd. v. State of Bihar[AIR 1955 SC 661 : (1955) 2 SCR 603, 646 : 1955 SCJ 672] it was held that “a legal fiction is to be limited to the purpose for which it was created and should not be extended beyond that legitimate field”.

This was reiterated in CIT v. Amarchand N. Shroff [AIR 1963 SC 1448 : 1963 Supp (1) SCR 699, 709 : (1963) 1 SCJ 411], Maharani Mandalsa Devi v.

M. Ramnarain (P) Ltd. [AIR 1965 SC 1718 : (1965) 3

SCR 421, 424 : (1965) 2 SCJ 853] and CIT v. Vadilal Lallubhai [(1973) 3 SCC 17, 22 : 1973 SCC (Tax) 1, 6 : AIR 1973 SC 1016 : (1973) 1 SCR 1058, 1064]. Assuming, therefore, that an application for variation of the conditions of a permit referred to in sub-section (8) of Section 57 is to be deemed by a fiction of law to be an application for the grant of a new permit, the question to which we must address ourselves is for what purpose is such an application for variation deemed to be an application for grant of a new permit.”

Therefore, when we consider the instant case, the purpose of the retrospective legislation is to make the ITSC inoperative right from the date of the introduction of the Bill and to send all the pending applications to the Interim Board. Therefore, fixing the last date for filing the applications alone travels beyond the purpose and results in more retrospectivity than which is needed and thus, runs counter to the other parts of the Act. As a matter of fact, as per the principle of lex prospicit non respicit (law looks forward not back) it can be seen that the purport of the legislation is only to do away with the policy of resolution through ITSC. As a matter of fact, the Central Government has to make a Scheme for the purposes of Settlement in respect of pending applications by the Interim Board as per Section 245D(11) and such scheme had to be placed before the Parliament. Thus, neither there is any intent nor it is within the purpose to do away with the ‘pending applications’ in respect of matters in which the ‘cases’ arose from 01.02.2021 to 31.03.2021. Thus, we find that it is just and necessary to read down the last date mentioned for filing applications in Section 245C(5) as 31.03.2021 and consequently the last date mentioned in paragraph No.4(i) of the Circular should also read as

31.03.2021. The Question No.ii is answered accordingly.

Question No.iii :

41.As per our findings in respect of Questions No.i and ii, thereby reading down the statute in respect of the date as 31.03.2021, the petitioners:(i) all the applications in respect of the petitioners even in respect of the cases arising between 01.02.2021 to 31.03.2021 shall be deemed as pending applications for the purposes of consideration by the Interim Board; (ii) Wherever they are rejected on the ground that they did not have a case pending as on 31.01.2021, such orders shall stand set aside and the applications shall be deemed to be pending applications for the consideration by the Interim Board, if otherwise in order and eligible, and shall be dealt with in accordance with law on merits in accordance with the scheme that may be framed by the Central Government as in respect of the other cases which arose prior to 31.01.2021.

The Result :

42.In the result, these writ petitions are partly allowed and are disposed off on the following terms :-

(i) Section 245C(5) of the Income Tax Act, 1961 (as amended by the Finance Act, 2021) is read down by removing the retrospective last date of 1st date of

February, 2021 as 31st day of March, 2021;

(ii) Consequently the last date of eligibility mentioned paragraph 4(i) of the impugned circular dated 28.09.2021 shall also be read as 31.03.2021;

(iii) all the applications in respect of the petitioners even in respect of the cases arising between 01.02.2021 to 31.03.2021 shall be deemed be pending applications and shall be deemed to be pending applications for the purposes of consideration by the

Interim Board;

(iv) Wherever they are rejected on the ground that they did not have a case pending as on 31.01.2021, such orders shall stand set aside and the applications shall be deemed to be pending applications for the consideration by the Interim Board, if otherwise in order and eligible, and shall be dealt with in accordance with law on merits in accordance with the scheme that may be framed by the Central Government as in respect of the other cases which arose prior to 31.01.2021;

(v) No Costs. Consequently all miscellaneous applications shall stand closed.

(S.V.G., CJ.) (D.B.C., J.)

17.11.2023

Index : Yes

Speaking Order Neutral Citation : Yes

klt

To:

1.The Secretary, Union of India,

Ministry of Finance, Department of Revenue,

3rd Floor, Jeevan Deep Building, Sansad Marg, New Delhi – 110 001.

2.The Chairperson, Central Board of Direct Taxes, Department of Revenue – Ministry of Finance, Government of India, New Delhi.

3.The Secretary, Interim Board of Settlement,

Replacing the Income Tax Settlement Commission,

Additional Bench, Chennai, Represented by its Secretary,

Satguru Complex, 640, Anna Salai, Nandanam, Chennai – 600 035.

4.The Assistant Commissioner of Income Tax, Central Circle-1(1), Chennai – 34.

THE HON’BLE CHIEF JUSTICE

AND

D.BHARATHA CHAKRAVARTHY, J.,

klt

W.P. Nos.13455 of 2021 etc., (batch cases)

17.11.2023

https://x.com/sekarreporter1/status/1725492704782803174?t=FurLwR3Easw9c16fnA56aQ&s=08

https://x.com/sekarreporter1/status/1725492704782803174?t=FurLwR3Easw9c16fnA56aQ&s=08

11/17, 18:02] sekarreporter1: The First Bench of the Madras HighCourt upheld the provisions of the amendments made in the Finance Act, 2021 with regard to abolition of Income Tax settlement Commission and however held that Section 245C(5) of the Income Tax Act, 1961 (as amended by the Finance Act, 2021) is read down by removing the retrospective last date of 1st date of February, 2021 as 31st day of March, 2021 and Consequently the last date of eligibility mentioned paragraph 4(i) of the impugned circular dated 28.09.2021 shall also be read as 31.03.2021. ARL Sundaresan, ASG appeared for Union of India assisted by Rajesh Vivekananandan, DSG and A.P.Srinivas, Senior Standing Counsel appeared for the Income Tax Department. [11/17, 18:02] sekarreporter1: Super https://sekarreporter.com/11-17-1802-sekarreporter1-the-first-bench-of-the-madras-highcourt-upheld-the-provisions-of-the-amendments-made-in-the-finance-act-2021-with-regard-to-abolition-of-income-tax-settlement-commissio/